Filenews 4 July 2025 - by Marcus Ashworth

Supporters of a strong euro must be careful what they wish for. If the common currency is strengthened much more, it will drown out the eurozone's economic recovery – albeit likely anaemic – before it even begins.

If the experience of the last decade turns out to be true, a very strong euro is the last thing the eurozone needs. Former European Central Bank President Mario Draghi has always tried to avoid mentioning the currency's strength, but was forced to raise the issue in 2014, 2017 and again in 2018. However, his most recent prophetic intervention on the "future of European competitiveness" is the one that matters most now.

There has been much to be said about the European Union's huge spending on defence and infrastructure, with Germany leading the way, and expectations – notably from European Central Bank President Christine Lagarde – that the common currency will benefit from the weakening of the dollar.

As with most commentary on the dollar, several bullish scenarios for the euro confuse the use of a currency with the distinct concept of relative value between a currency pair. There is little evidence that the euro is becoming the international currency of business beyond its sphere of influence. Gold has usurped the euro's position, according to the ECB's annual assessment, now occupying the second largest share of global central bank reserves. According to research by the World Gold Council, this trend is likely to be maintained without threatening the dollar's primacy in global use or inventories.

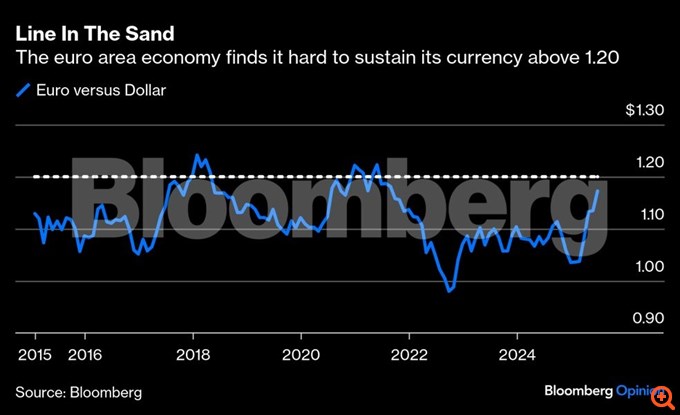

Indeed, the euro has gained 13% against the dollar this year, but its 3% appreciation against sterling is perhaps more revealing: The ECB has cut interest rates at a faster pace than the US Federal Reserve and the Bank of England over the past year, but this has almost no effect on the valuation of its currency. So, while the euro has for the time being secured favourable conditions, it will need a fiscal cavalcade to really boost its domestic demand. Of course, in relative terms, other economies should also not perform so strongly. We are asking for a lot here.

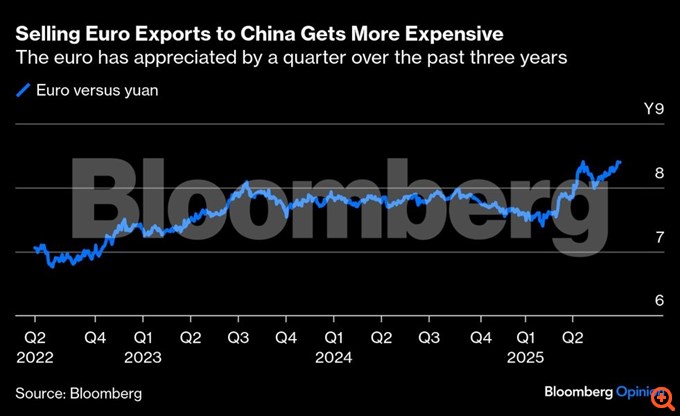

The euro area may still be the largest collective single market, but its economic momentum is always driven by exports of manufactured goods. This explains why the EU is currently in talks on tariffs with the Trump administration. Germany's current account surplus of 250 billion euros. is the largest in the world, surpassing even Japan last year. What used to be a key advantage of the EU is now an Achilles heel. A stronger euro only makes it harder for the bloc to maintain its export volume.

Public interventions by officials have already begun. ECB Vice President Luis de Guindos said on Bloomberg television on Tuesday that a rise in the euro above $1.20 "would be much more complicated. But 1.20 is perfectly acceptable."

On a commercially weighted basis, the euro has never been stronger, according to the ECB's measurement of 41 currencies. The weakness of the dollar is still the most important factor, as a fifth of EU exports go to the US, but the relative value of the Chinese yuan is almost as important as bilateral trade at €740 billion. in 2023.

Bloomberg Intelligence's chief strategist, Audrey Child-Freeman, warns that the ECB will fear that euro gains will accelerate if the US economy weakens. This faster rate of growth of the euro may prompt the ECB to cut interest rates further, even below the preferred neutral area near 2%, where the deposit rate now stands. To be fair, there will also be counterproductive effects, such as reducing the cost of imports, which could over time reduce household spending and boost disposable income and consumption. However, with inflation in the euro area below the ECB's 2% target, deflation risks may be the biggest problem. Inflation in France in June stood at 0.8% (year-on-year).

A dynamic, competitive economy can withstand a stronger currency, as the German mark witnessed before the adoption of the euro. But a troubled euro economy that is growing at a rate of just 1% is far from that. There's a reason the ECB halved its interest rate in the last year. The implementation of the promised fiscal expenditure, and indeed immediately, is crucial for the further growth of the euro. Relying on defence is crucial, but listening to Draghi's call to boost competitiveness is also crucial. In order for the euro to be able to claim its place – and to believe it – on the world stage, it will first have to solve its internal issues.

Rendering – Editing: Lydia Roubopoulou