From Wall Street to Washington, tariffs have been the subject of much heated — and charged — debate in recent weeks. As Americans try to figure out the logic behind the trade barriers introduced by the administration — most recently Tuesday's threat to double tariffs on Canadian steel and aluminium, its implementation is now uncertain — it's worth keeping a few general points in mind.

One of them is that the measures are essentially a tax on Americans. It doesn't mean that foreign countries just pay more — costs go up for U.S. companies when they import a product. This, in turn, means that the costs are ultimately borne by consumers and companies using imported raw materials. The effect of these higher prices is to reduce household disposable income, reduce real wages and economic growth.

Even if voters were willing to tolerate higher prices, tariffs would likely mean fewer American jobs. Ceteris paribus, as costs rise, demand falls. Lower demand reduces production, which leads to less employment. If other countries retaliate – as many plan to do – these effects will worsen, which translates into even higher prices and fewer jobs.

At the same time, this protectionism will not revive U.S. manufacturing. Tariffs reduce competition, making it easier for domestic companies to survive on worse products and less efficiency. A glaring example is the tariffs imposed on foreign cars in the 1970s and 1980s, blinding American automakers who saw no need to innovate in both vehicle design and production and allowing their Japanese competitors to take the lead.

History offers many other "bells". A previous round of tariffs on steel and aluminium in 2018 increased production costs and consumer prices, hampered exports and resulted in about 75,000 fewer manufacturing jobs. Each job saved in targeted industries cost about $650,000. Similar dynamics were seen when President Barack Obama imposed tariffs on Chinese tires in 2009 and tariffs on steel under President George W. Bush in 2002.

The current government's plans — which include 25 percent tariffs on most goods from Canada and Mexico, as well as 20 percent tariffs on goods from China — could prove particularly costly. One study found that it would equate to a tax of more than $1,200 per year for an average household in the US. Growth could contract by 0.4% or more, with up to 400,000 jobs potentially at risk. And that doesn't include plans for 25 percent tariffs on imports from Europe and new tariffs on agriculture, cars, chips, copper, timber products, pharmaceuticals and more.

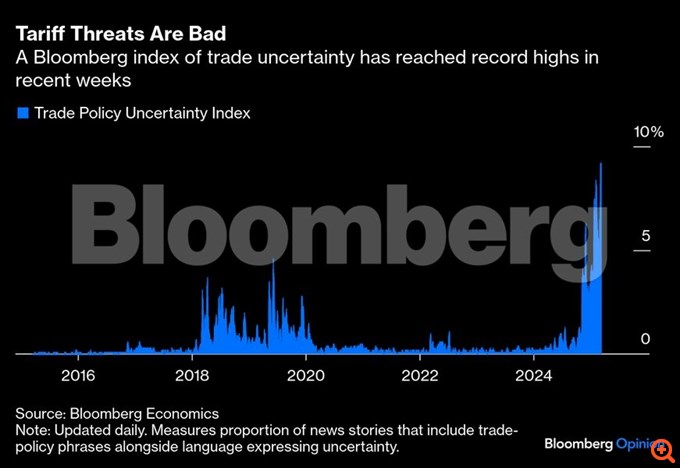

But beyond the direct economic damage, these measures threaten to entangle the U.S. in years of haggling, impose huge administrative costs, and further erode the rules-based global trading system that has facilitated overall prosperity gains. Additional uncertainty will hamper investment. Not to mention the diplomatic damage caused by the U.S. choosing to turn its back on its allies.

Most importantly, American companies shouldn't be afraid of competition. The most successful American businesses did not succeed because of the tariffs. They succeeded by leveraging entrepreneurship and providing better products and services at lower prices. Protectionist companies are sending the message that they cannot compete with their "rivals" without the help of the government, which should be a red flag.

Congress and the White House should not hand out privileges to such companies. Instead, they should adopt policies that incentivize investment and growth, encourage research and development (R&D), create a skilled and creative workforce, modernize infrastructure, and, yes, welcome more talented immigrants to work in the U.S. and establish the next generation of great companies.

This is the American way – or, at least, that is how it should be.

Performance – Editing: Lydia Roumpopoulou /