BBC News 29 March 2021 - by Mary-Ann Russon, Business Reporter

|

| Tug boats working on the Ever Given on Saturday night |

A huge container ship that has been wedged in the Suez Canal since Tuesday has been partially refloated.

Richard Mead, managing editor of shipping journal Lloyd's List, told the BBC's Today Programme that somebody within the salvage operation had confirmed "that the Ever Given was refloated about 4.30am this morning local time".

The situation has been the source of much worry and frustration for the global shipping industry.

We take a look at the key numbers that have been involved in the operation.

The numbers are big

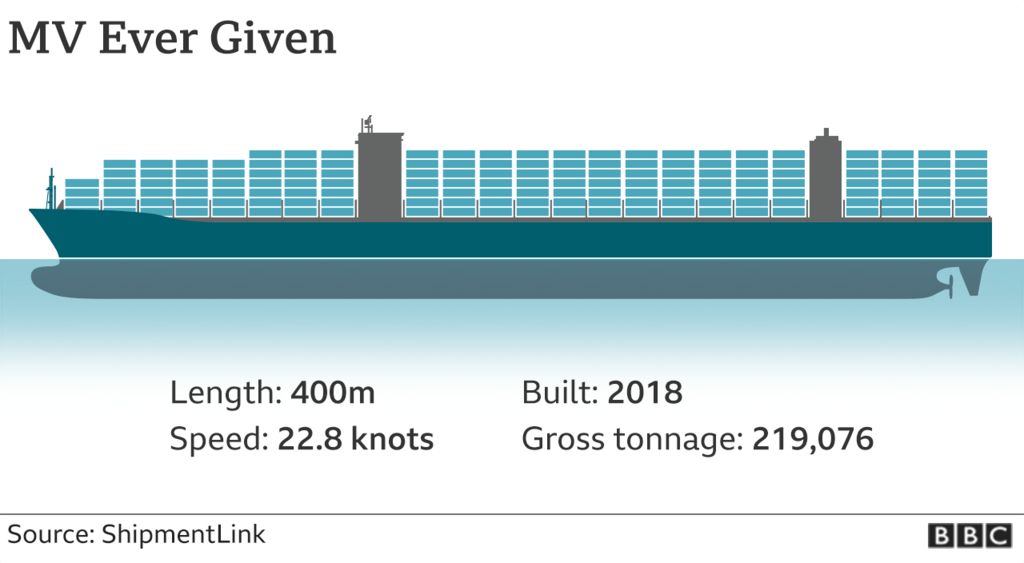

The Ever Given is 400m-long (1,312ft) and weighs 200,000 tonnes, with a maximum capacity of 20,000 containers. It is currently carrying 18,300 containers.

The ship is operated by Taiwanese transport company Evergreen Marine and is one of the world's largest container vessels.

It became stranded on Tuesday, after running aground and becoming lodged sideways across the waterway. At first a gust of wind was thought to be to blame .

The wind speed at the time was recorded at 40 knots, but the Suez Canal Authority (SCA) told reporters that this was not the only reason for the ship becoming stranded.

An investigation would be needed to determine whether technical or human errors occurred, the authority added.

As of Sunday, there were 369 ships stuck in a tailback waiting to pass through the 193km (120-mile) canal on either side of the blockage.

Meanwhile, there have been more than 145,200 social interactions on Twitter using the #SuezBLOCKED hashtag and at least 133,000 shares, according to real-time analysis by brand monitoring platform BrandMentions.

How are efforts to free the ship going?

Over the weekend 14 tugboats pulled and pushed the Ever Given at high tide to try to dislodge it and were able to move the ship "30 degrees from left and right".

Early on Monday, maritime services company Inchcape reported the vessel was freed.

Video posted on social media on Monday appeared to show the stern of the Ever Given swung towards the canal bank, opening space in the channel.

Mr Mead of Lloyd's List told the BBC that some smaller ships have already started transiting past the vessel.

"We're looking at about 450 ships still waiting to transit the canal. It's going to be a lengthy process clearing that backlog," he said.

How much is the blockage costing?

About 12% of global trade, around one million barrels of oil and roughly 8% of liquefied natural gas pass through the canal each day.

General Rabie told reporters on Saturday that the Canal's revenues were taking a $14-$15m (£10.2m-£10.9m) hit for each day of the blockage.

This is despite the fact that the canal opened an older channel to try to get more ships through.

Prior to the pandemic, trade passing through the Suez Canal contributed to 2% of Egypt's GDP, according to Moody's.

Separately, data from Lloyd's List showed the stranded ship is holding up an estimated $9.6bn of trade along the waterway each day. That equates to $400m and 3.3 million tonnes of cargo an hour, or $6.7m a minute.

Looking at the bigger picture, German insurer Allianz said on Friday its analysis showed the blockage could cost global trade between $6bn to $10bn a week and reduce annual trade growth by 0.2 to 0.4 percentage points.

Shipping broker Braemar ACM told the Wall Street Journal that the cost of renting some vessels to ship cargo to and from Asia and the Middle East had jumped 47% to $2.2m.

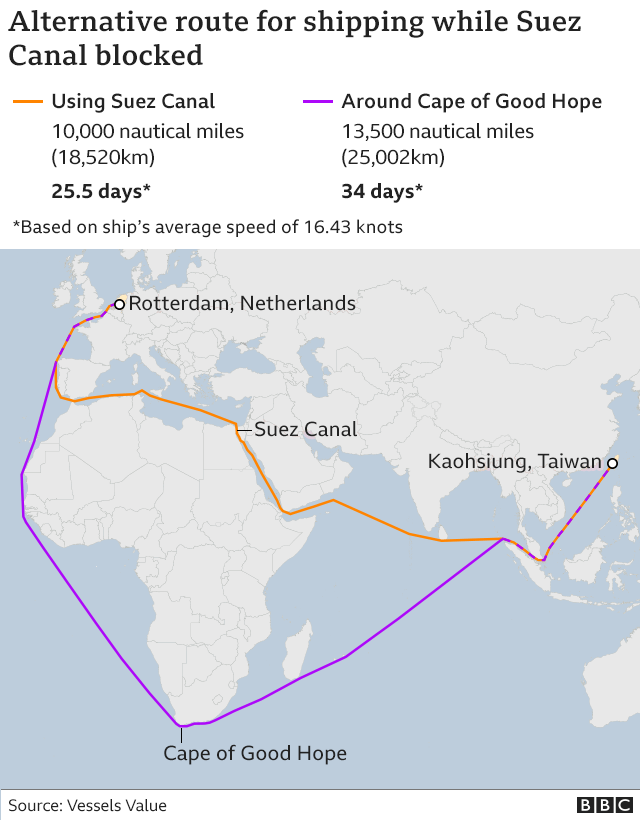

Some vessels are being rerouted to avoid the Suez Canal. That is adding around eight days to their total journeys.

Countless businesses affected

The Suez Canal blockage doesn't just affect the global shipping industry or the Egyptian economy - countless businesses, from domestic transport providers to retailers, supermarkets and manufacturers are also impacted.

The true damage and cost is difficult to evaluate until the ship is fully freed and trade resumes, but many firms will have to make critical decisions if the blockage continues for another week.

British firms told the BBC on Friday that they were still waiting to find out when goods are likely to arrive.

If the situation at the Suez Canal continues, some firms will have to pay to order more goods and have them sent over by air freight, which costs at least three times more.