The numbers for the present tell a nice story, but what will the future bring?

The Cyprus real estate market in 2025 is recording steady growth and resilience, in contrast to the slowdown trends in several European countries.

Data from the Land Registry Department show a 16% increase in sales documents in the first half of the year, reaching 8,729 transactions, while the total value of transfers amounted to €2.3 billion.

Experts agree that Cyprus remains an attractive investment destination, combining resilience, liquidity and opportunities, while the market outlook will depend on the ability to maintain a balance between supply and demand and address the issue of housing affordability.

Also, specific trends seem to be consolidating in the Cypriot real estate market, according to the latest data of the "RICS Cyprus Property Price Index with KPMG in Cyprus" for the second quarter of 2025.

The picture depicted shows that, as long as there are no upheavals in the domestic and international environment, the market will continue to move with differentiations by category and geographical area.

Larnaca emerges as a protagonist, recording the highest overall growth, especially in residences and warehouses.

In Nicosia, there is a stable residential performance, with a continuous increase in both houses and apartments.

In contrast, in Limassol prices remained almost unchanged, with reductions in warehouses and commercial properties.

Paphos recorded a sharp drop in warehouses, although apartments moved upwards. Stability is recorded in office spaces, with Famagusta standing out for the largest increase.

By property category, residences experienced the largest increase on a quarterly basis, followed by warehouses and apartments. Commercial real estate remains the weakest link, confirming the sluggishness of the sector.

In a year-on-year comparison, the largest increases are found in apartments and houses, with smaller profits in offices and warehouses, while commercial ones recorded limited changes.

Rentals continue their upward trend, with apartments recording the largest percentage increase, followed by warehouses. Smaller increases are recorded in the other categories, while a slight decrease appears in commercial real estate.

Holiday properties show particular dynamics, with apartments leading the way, reflecting the ongoing demand linked to tourism. The largest increases are found in Larnaca, while Paphos records more limited profits.

In terms of yields, marginal changes were recorded compared to last year. Apartments showed a yield of 5.41% compared to 5.43%, houses 2.97% compared to 3% and commercial properties 5.75% compared to 5.80%. Offices recorded stability (5.61%), while there were minimal deviations in warehouses and holiday properties.

We invited three industry professionals, Marinos Kynagerou, president of the Real Estate Agents Registration Council, Pavlos Loizou, CEO of Ask Wire and Andreas Christoforides, CEO of Landbank Group, to submit their views.

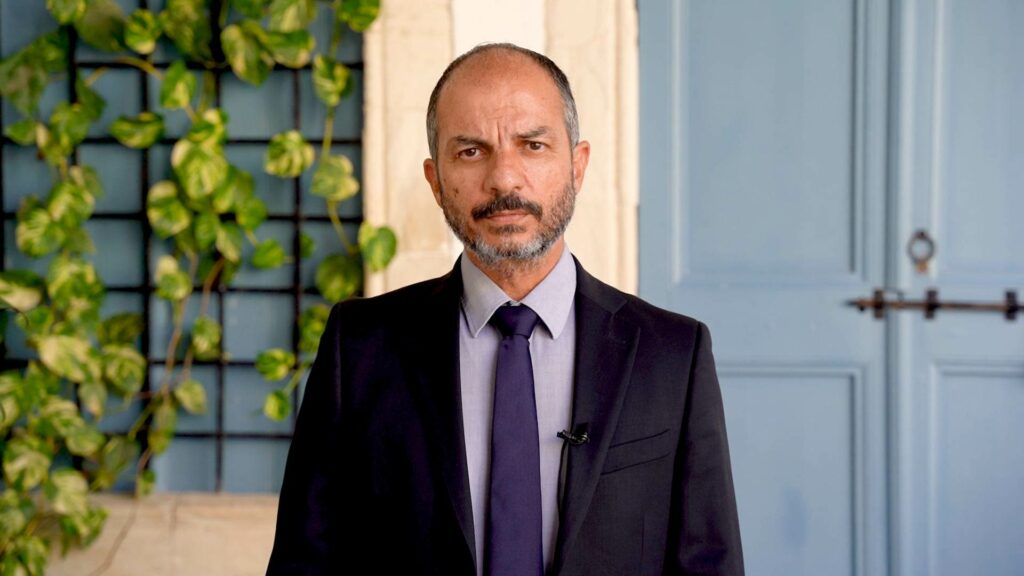

ANDREAS CHRISTOFORIDIS CEO LANDBANK GROUP

THE PROSPECTS OF THE REAL ESTATE MARKET ARE AUSPICIOUS AND PROMISING

The Cyprus real estate market in 2025 is characterized by steady growth and resilience, in contrast to what we see happening in several European markets.

Indicative of the progress are the data of the Department of Lands and Surveys for the first half of this year, according to which 8,729 sales documents have been submitted, increased by 16% compared to the corresponding period of 2024.

During the same period, a significant increase of 10% was recorded in the total value of transfers, which reached €2.3 billion.

Confirming the continuous but balanced market dynamics, the Central Bank's House Price Index (houses and apartments) recorded an increase of 1.9% in the first quarter of 2025, compared to 0.4% in the previous quarter.

Softer price increases – More liquidity

House prices in Cyprus recorded milder increases, as during the period under review they are significantly below the average of both the eurozone and the EU.

According to Eurostat, house price growth in the first quarter of 2025 reached 5.4% in the Eurozone and 5.7% in the EU.

This comes as the real estate market in Europe is still facing challenges, such as a shortage of available housing and rising rental prices, trends that are amplifying pressure on the market.

In Cyprus, the data is clearly better, as the availability of real estate has increased, hence the milder rise in prices. While in the Eurozone and the EU the real estate market is showing signs of slowing down in Cyprus, we observe that there is mobility as the market is more liquid and attractive to investors.

Stability and Durability

Between 2010 and 2023, house prices in the EU increased by 48%, with average annual rates hovering between 3–4%. Cyprus, although it recorded a slight decline at the beginning of the previous decade, is now charting a more stable and resilient path.

In contrast, in countries such as Germany and France, the market has a more problematic picture. In Germany, for instance, commercial real estate prices fell by 5.4% in 2024, while property transactions in Europe saw a decline of up to 26% in the first quarter of 2024, demonstrating the challenges and volatility in the markets.

What makes the Cypriot market attractive

The attractiveness of the Cyprus real estate market is based on three main pillars.

First, the market has a steady growth trajectory, with balanced price growth with controlled fluctuation, unlike other European countries that face risks of overvaluation and even collapse. Therefore, this course inspires confidence and security in investors.

Second, the Cypriot market is characterized by live liquidity, especially in high-value transactions of €20–50 million. This makes real estate particularly attractive to institutional investors and family offices.

Thirdly, it maintains a favourable legal and tax environment on highly competitive terms. Advantages are offered, for example, in terms of reduced interest rates, standardised trading formulas and favourable programmes such as the 'Golden Visa', which attract international investors.

According to recent reports by the European Central Bank, house price cycles in the Eurozone have a milder decompression and faster recovery than past debts and crises. And while some markets, such as Spain, Portugal and Eastern European countries record double-digit percentages in price increases, Cyprus shows a more balanced and stable course in the long term.

The Cyprus real estate market goes beyond the definition of a simple market, as it is a pillar of stability, combining resilience, liquidity and perspective. In contrast to other European markets, which present a risk of bubble or fragmentation, the Cypriot market is following a sound and healthy course. This feature allows it to offer consistent returns without being fueled by overheating, making it ideal for long-term investment strategies such as those of family offices.

PAVLOS LOIZOU CEO ASK WIRE

TWO SPEEDS, ONE OBSTACLE: ACCESSIBILITY

The real estate market in Cyprus maintains its momentum, with growth continuing in 2025, despite the pressures exerted by inflation and high interest rates.

In the first half of the year, the second highest performance since 2000 was recorded, as sales nationwide reached 8,729 and their total value exceeded €2.3 billion.

The market is demonstrating remarkable resilience, with factors such as limited supply, increased investor confidence, and the stability of the macroeconomic environment acting as a shield against challenges.

However, its course in the coming years will largely depend on the evolution of current trends and the response to critical challenges, with affordability emerging as the greatest of them.

The main trends shaping the present

The market moves at two speeds, with a clear geographical and demographic differentiation.

Limassol remains the leader in transaction value, attracting affluent foreign buyers seeking high-value properties.

In contrast, Nicosia has the largest sales volume, mainly serving the domestic demand for permanent residence.

Larnaca, with new projects and comparatively lower prices, shows the largest increase in the number of sales documents, while Paphos is boosted by tourism and investment demand. In terms of prices, the Central Bank's indicators show that apartments increased by 8-9% in 2024, in contrast to single-family homes which recorded an increase of around 6%. The differentiation is even more pronounced geographically, with Paphos and Famagusta recording increases of more than 10%, while Nicosia only 2-3%.

Residences, and in particular apartments, are the main driver of market growth, accounting for more than 60% of transactions in residential real estate.

The price of apartments increased at a faster rate than single-family homes, demonstrating the shift of buyers to more affordable units.

This trend is directly linked to the new demand, which is shifting towards smaller and more energy-efficient properties. Developers are adapting by incorporating features such as photovoltaics and heat pumps, as energy consumption has now become a critical cost factor.

The Effect of Inflation and Interest Rates

Inflation and elevated lending rates have impacted the market, partially slowing demand, particularly from local buyers who rely on bank financing. The annual value of new mortgages fell by 15% in 2024, yet the market showed resilience, with prices rising at a slower pace, thus avoiding overheating. Foreigners, who make up 35-40% of buyers and pay mainly with equity, remain active, maintaining high mobility in the coastal provinces.

The rental market is also showing strong demand, with their prices increasing rents by around 10% in 2024. The high cost of buying and financing is pushing many households, especially young couples, to turn to renting. Leases now act as an "antechamber" for the market, as citizens postpone the goal of owner-occupied housing for the future.

The biggest challenge and the prospects

The biggest challenge of the market is affordability. In Limassol, prices have reached historically high levels, while the house price-to-income ratio has increased significantly, compared to other European countries.

The price-to-rent index for Cyprus exceeds 16, indicating that buying a house remains much more expensive than renting. At the same time, construction activity focuses on high-value projects, limiting the supply of affordable housing. The solution to this problem requires coordinated interventions by the state and the market to support the primary residence.

Despite the challenges, the prospects of the Cypriot market remain positive, with the return of large institutional investors sending another positive message. For example, the acquisition of Venus Rock in Paphos by the Columbia Group, a record-breaking transaction worth €130 million, marks the return of the big players and confirms the attractiveness of Cyprus as an investment destination for large-scale projects.

It is very important that the real estate market in Cyprus is showing signs of rebalancing, without overheating. Its course in the coming years will depend on how effectively the challenge of affordability will be addressed, the further development of construction activity, the attraction of foreign investment and the ability of the market to meet the needs of local buyers.

MARINOS KINAGIROU PRESIDENT OF THE REAL ESTATE AGENTS' REGISTRATION COUNCIL

THE DYNAMICS OF THE REAL ESTATE MARKET COMBINE STABILITY AND OPPORTUNITIES

The Cyprus real estate market continues to demonstrate remarkable resilience and dynamism, despite exogenous challenges. After a strong year in 2024, 2025 has started and is evolving just as strongly, confirming continued demand from both local buyers and foreigners, especially from countries like Israel and Lebanon, where geopolitical tensions have not negatively impacted investor interest.

Property supply and price stability

One of the most encouraging elements of this period is the significant supply of real estate present in the market, catering to a wide range of needs. This balance between demand and supply is the main reason why property prices remain broadly stable.

According to Eurostat, Cyprus maintains a more moderate course compared to the rest of Europe. Specifically, in the first quarter of 2025, the annual increase in prices in Cyprus amounted to 2%, a percentage much lower than the average of the European Union (5.7%) and the Eurozone (5.4%). This picture shows that while the market remains active, it is not under the same upward pressures as other European countries.

Increased demand

Keeping prices high mainly affects local buyers, as general inflation wears out their disposable income, which is why there is a change in the buying behaviour of locals.

In particular, we see that more and more people are turning to apartments, as prices for buying houses are often unaffordable, especially in cities where there is increased buying interest. Demand from foreign investors can be described as strong, while undoubtedly contributing to keeping prices high.

An additional important factor fueling demand, mainly from Cypriot investors, is the extremely low deposit rates of Cypriot banks. With returns on deposits being negligible, many are turning to the real estate market as a more attractive and profitable investment option.

At this point it is important to dispel the myth that licensed real estate agents "inflate" real estate prices. Our role is to offer the best possible rates to facilitate trading. Market prices are primarily set by property owners and are ultimately determined by the basic principle of the economy, which is supply and demand.

Each province and a different story

Analyzing the Cypriot real estate market, we will see that it varies from province to province.

Limassol maintains the primacy in expensive and luxurious real estate.

Paphos has been in increased demand in recent years, from both foreign and Cypriot investors.

Larnaca is of particular interest, especially for small apartments, as prices are even more affordable compared to other cities, while Nicosia is oriented towards local buyers/investors and the free province of Famagusta towards holiday homes.

Challenges and Prospects

While the real estate market offers significant opportunities for investors, it simultaneously addresses the critical challenge of affordable housing for Cypriot citizens. Access to homes, especially for young people, is becoming increasingly difficult. The Government and the competent bodies are called upon to examine and implement policies that will support local buyers.

Critical factors for the further course of the market will be the continuous flow of foreign investment, which is a key pillar of growth, but also the full balancing of demand with supply, especially in the categories related to primary residences.

Furthermore, we see that the market is adapting to modern trends, such as buildings with higher energy efficiency and green technologies, which are expected to gain ground and be a driving force of the market.

In addition, the increasing demand for rental properties, due to the difficulty in the market, creates new investment opportunities for those looking to enter the market with lower risk. The digitalization of transactions and the use of technology are also expected to improve the efficiency and transparency of the sector.

As the Real Estate Agent Registration Council, we believe that continuously monitoring trends and adapting to market conditions is essential for maintaining healthy growth.

FROM INSIDER MAGAZINE