By Earl Carr

Some believed that Trump's meetings with Putin in Alaska and with Zelensky in the Oval Office marked the start of a new round of serious negotiations for peace in Ukraine. The reality is that peace talks between Russia, Ukraine, the US and Europe have been interrupted, if not ended, with many disagreements on both sides over security issues and, most notably, trade sanctions. Putin is stepping up his attacks and pushing for further military gains, defying Trump's deadlines for starting serious peace talks. Moreover, at the September 3 military parade in China to mark the 80th anniversary of the country's victory over Japan in World War II, Putin and Xi, side by side, sent a clear message to President Trump: your tariffs will not prevent a new world order.

During the Russia-Ukraine war, sanctions from Europe and the US have escalated against Moscow and its trading partners. Secondary sanctions have also been imposed, mainly to prevent Russia from using intermediaries in other countries to maintain - unaffected - its role in the global economy. According to press releases from the US Treasury Department, the Office of Foreign Assets Control (OFAC) has intensified sanctions against more than 400 individuals and entities in 17 different countries in the last year. This has forced Russia to rely heavily on China, especially to prop up its wartime economy and, more importantly, to continue exporting its most important commodity: crude oil.

In fact, over the past five years, China has become the largest buyer of Russian oil, sourcing about 50% of the crude that Russia exports. Bilateral trade between Moscow and Beijing increased to 244,8 billion. dollars in 2024, on the one hand due to Western sanctions and on the other hand due to wartime demand. For its part, China supplies Russia with cars, semiconductors and consumer products. The two countries have also increased their transactions in roubles and yuan. In December 2024, Putin announced that 90% of the two countries' transactions are settled in their national currencies, bypassing the Western financial system. Just 18% of Russian trade is conducted in dollars or euros, compared to 87% and 67% of imports and exports, respectively, at the beginning of 2022.

China has directly supported Russia's military operations, with reports linking Chinese companies to the shipment of gallium, germanium and antimony – key raw materials for making missiles and drones – while Beijing bans their export to the US. A fundamental question that many analysts are asking is whether Russia's wartime economic dependence on China is a tactical approach or symbolizes a longer-term strategic realignment.

Russia is accustomed to Western pressure and economic sanctions. In 2014, when Russia annexed Crimea, it looked like today. The sanctions targeted Moscow's access to Western financial systems, energy exports and the defense industry. As a result, many Western banks, Exxon, BP and other companies withdrew or reduced their activity in Russia. Then Moscow turned to Beijing, signed the Power of Siberia pipeline agreement, and accelerated the development of payment systems such as Mir and the System for Transfer of Financial Messages (SPFS) to bypass the Western financial system. This move by Russia laid the foundation for its current manoeuvres under pressure from the West.

Even when milder sanctions were imposed in 2018, during the chemical attack in Salisbury, allegations of Russian interference in the US election and cyberattacks did not cease. Russia has "run" its de-dollarization policies by increasing its gold reserves and diversifying its monetary trade settlement portfolio. A practice dating back to the Cold War: when Washington restricted technology exports through the Coordinating Committee on Multilateral Export Controls (CoCom), the Soviets retreated and adapted, trading with neutral states and relying on the Eastern bloc.

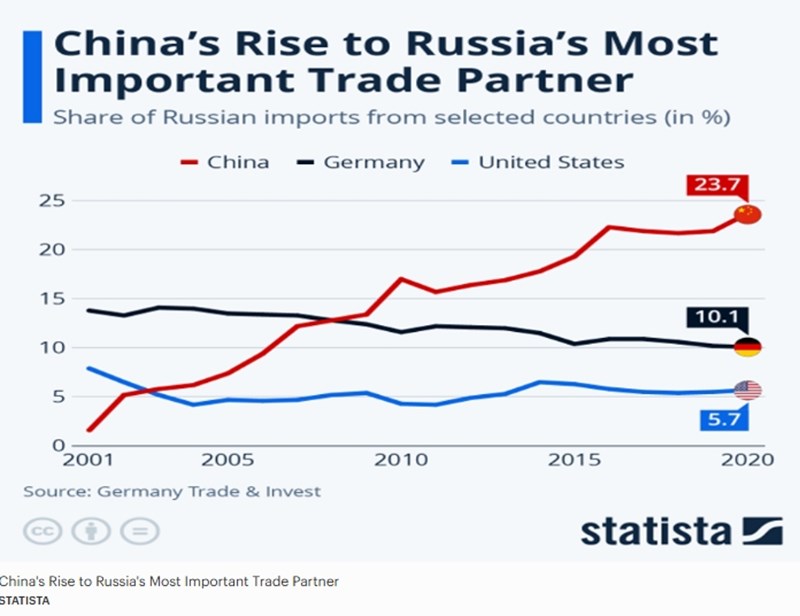

When pressured, Russia is always looking for solutions – usually outside the West. This suggests that Russia's relationship with China does not simply arise out of necessity, but is a sign of a further rearrangement that has been underway for decades. Trade data supports this trend, as China has overtaken Germany and the US, which were previously very important trading partners. However, history also shows that once sanctions are eased, Russia rebuilds its relations with the West and Europe. After 2014 and the annexation of Crimea, Russian exports to Germany increased. The current Russia-China partnership will probably be maintained in peacetime, but it is certainly not an unchanging relationship.

The energy sector is perhaps the most important aspect of the rapprochement between Russia and Beijing. With the destruction of the Nordstream pipelines and Europe's shift to alternative suppliers, the Old Continent has entered into agreements to reduce its dependence on Russia. This change is reinforced by Moscow's attempt to expand its infrastructure eastward through the Power of Siberia pipelines.

Europe's energy mix has already been restructured: energy imports from Russia have fallen significantly and have been partially replaced by agreements with the US, Norway and Libya. Even if there were a post-war settlement, the new energy supply chain for Europe probably wouldn't have Russia at its top. It is an opportunity for Europe to switch to renewable energy sources and develop more nuclear, wind and hydropower infrastructure in order to meet its energy needs and downplay Moscow's role in the energy market.

Russia is interested in increasing its exports to Asia due to Western sanctions. China plays a primary role here. In the energy market, it seems that commercial blocs of the "Cold War" type are being created. Instead of a globalized market, the rise of parallel energy poles is observed. Fragmentation escalates geopolitical tensions and makes LNG and energy pipelines assets of strategic importance.

Equally important is the trend towards de-dollarization. China and Russia are increasingly trading in yuan and roubles and are increasingly excluded from Western markets through tariffs and sanctions. In this way, they are not only protected from the economic pressure of the West, but also develop the infrastructure for the creation of parallel financial networks. This creates a new financial "battleground" where Beijing and Moscow can promote trade settlements by excluding the dollar, especially in the energy sector but also in advanced industrial products. Such a development would undermine the dollar's dominance in the energy trading ecosystem and promote (from concept to reality) a multipolar financial world.