Filenews 12 June 2025 - by Bloomsberg Opinion Editorial Team

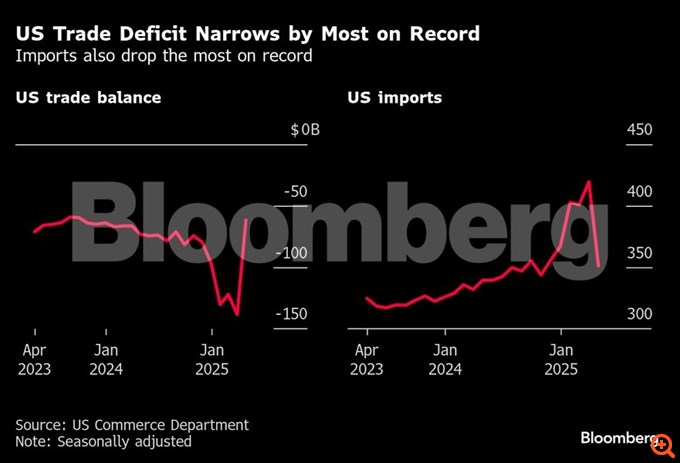

According to one school of thought, recent economic data may be a cause for celebration. The U.S. trade deficit narrowed dramatically in April. Growth will likely be higher in the second quarter of the year than in the first. And the report on new jobs published last week suggests that the labour market remains stable.

So, the government's aggressive new tariffs are paying off, right? No.

The huge uncertainty about trade policy, as well as attempts to predict upcoming developments, blur the picture. Until the fog clears, confidence indicators and other qualitative elements may offer a better guide to the underlying developments. Their message is discouraging.

At first glance, the labour market looks resilient: The unemployment rate remained stable at 4.2% in May, better than expected, and payrolls expanded. But employment figures for the previous months were revised downwards, and manufacturing jobs declined. The participation rate also decreased, meaning that unemployment did not increase in part because fewer people were now part of the labour force.

Fed respondents said they expect the tariffs to increase costs. Views differed as to whether these increases would be passed on to consumers (increasing inflation and delaying further interest rate cuts) or absorbed by businesses (reducing profit margins and discouraging investment). In any case, decisions on hiring and dismissal are on hold.

First, the supposed good news. After the announcement of the "Liberation Day" tariffs in early April, the trade deficit was reduced by more than half, to 62 billion euros. from $138 billion. in March. But that followed a surge in the deficit during the first quarter. In anticipation of the tariffs, consumers made early purchases and businesses hoarded foreign goods. (Inventories rose in the first quarter before shrinking in May.) All of this put pressure on GDP in the first quarter and will likely strengthen it in the second quarter.

The Institute for Supply Management's data on the services PMI shows similar signs. It reported a drop in demand and orders, combined with higher prices demanded by manufacturers and other suppliers. Again here, the reason is the tariffs.

It's still too early. For the most part, the government's trade measures – including so-called reciprocal tariffs – are currently on hold to allow bilateral talks. Discussions with the European Union and China in particular are not going well – if there is further retaliation and escalation, which include not only tariffs but also restrictions on imports of critical minerals to the US, things could quickly get worse.

Tariffs on steel and aluminium, which have just been increased to a punitive 50%, are sure to exacerbate the economy's problems. Steel is a key element in domestic construction and manufacturing. This policy is going to put obstacles in the way of the very producers that the White House wants to support.

If the current trade policy chaos finally results in sustainable, faster growth and a higher standard of living, it will be a miracle. Don't celebrate just yet.

Rendering – Editing: Lydia Roubopoulou