Filenews 28 June 2025

Robert Burges

Every researcher knows that the quality of a paper depends on the quality of the incoming data. Starting with bad data or assumptions and the result doesn't make sense. Let's take the White House's analysis of the "Big and Beautiful Bill" that Congress is trying to pass: it's pure "GIGO" – garbage in, garbage out.

Estimates by the nonpartisan Congressional Budget Office (CBO) show that the bill will add $2.42 trillion. Dol. budget deficits in the next decade. Not only that, but the CBO estimates that the debt will reach 117% of GDP in 2034 under current legislation, up from 97% recently. That's not the case, the White House says. In its analysis released this week, the Council of Economic Experts estimates that the bill will shrink deficits from 8.53 trillion dollars up to 11.1 trillion dollars and will reduce debt to 94% of GDP.

All U.S. governments are trying to present their economic policies in the best possible way. But the Council's efforts go far beyond the limits. His numbers are literally based on a financial miracle in the coming months.

In the Council's analysis, debt as a percentage of GDP immediately starts to shrink and falls about three percentage points below the CBO's forecast for fiscal year 2025. The problem is that there are only three months left in the financial year – it ends on 30 September – which makes the Council's objective practically impossible to achieve.

Jason Furman, former head of the Obama administration's Council of Experts, estimates that U.S. GDP will need to expand more than 10 percent annually in the third quarter to reach that goal. (The average estimates in a Bloomberg survey of more than 60 economists are for growth of 0.8%).

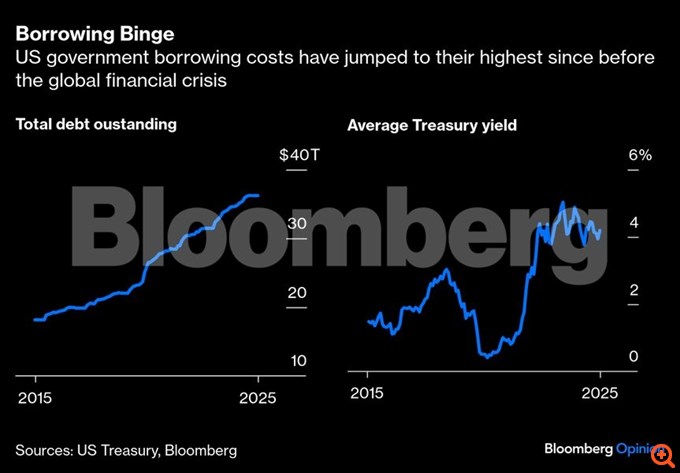

All of this may seem insignificant, but it is crucial as the U.S. fiscal strength and credit rating are called into question due to high debt and excessive deficits. Last month, Moody's Ratings became the latest of the big three credit rating agencies to remove the top "AAA" rating from the US, following S&P Global Ratings (in 2011) and Fitch Ratings (in 2023). "Successive U.S. governments and Congress have failed to agree on measures to reverse the trend of large annual budget deficits and rising interest rates," Moody's said.

Growing evidence suggests that the cost of borrowing for the U.S. government, and as a result for businesses and households, has risen as debt climbs above $36 trillion. Dol. At the same time, the Bloomberg Dollar Spot Index, which tracks the U.S. currency's performance against its main competitors, has plunged about 9% this year to its lowest level since 2022 amid concerns that foreign governments and investors are moving away from U.S. financial data.

It is likely that the Council's long-term forecasts will come true as tax cuts for businesses under the 2017 bill will become permanent and regulatory deregulation will stimulate investment, while tariffs will bring in more revenue. "The Council believes that the Great and Beautiful Bill and the broader economic policies advocated by the Trump administration will bring debt on a downward trajectory, while strengthening the foundations of U.S. financial stability and creating fiscal space for America to resolve current and future challenges," the Council said in its report.

That confidence would be easier to accept if the White House's predictions had a more realistic starting point. If the White House really believed in the long-term benefits of the bill, there would be no reason to try to mislead the American public with numbers that there is no chance of succeeding. And if the starting point is altered, how can one have confidence in the finish point? Garbage in, garbage out.