Cyprus Mail 26 February 2025 - by Tom Cleaver

President Nikos Christodoulides on Tuesday announced his intention to introduce sweeping tax reforms.

Speaking at an event held to present the government’s proposals at the presidential palace, he promised his reforms will strengthen Cyprus’ middle class, which he described as the “foundation of every prosperous and democratic society”.

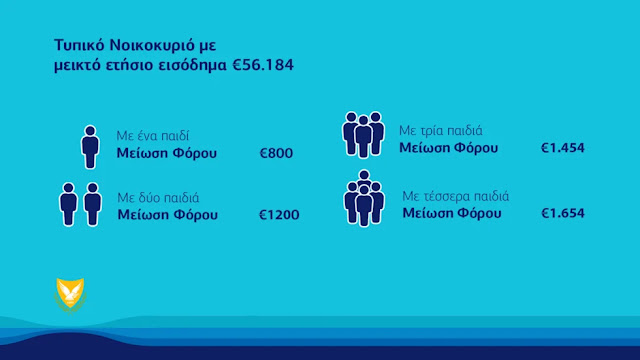

The most notable of his planned reforms is an increase in individuals’ tax-free incomes, while he also promised a “series of significant tax deductions which take into account the needs of households and the composition of the family”.

Christodoulides announced a new ringfence for an annual extra €1,000 of tax-free income per year for every person in Cyprus, as well as €1,000 of tax-free income for every dependent a parent has, €1,500 of tax-free income for every parent who is either buying their first house or renting, and €1,000 for a “green investment” on the part of every parent.

Single parents will receive double the ringfenced tax-free amount.

This in effect means ever person in Cyprus will, if the plans become law, be earning at least €20,500 per year tax free, with that figure rising for young parents and other groups benefiting from the extra tax free allowances.

He also promised that young people will be “essentially supported” with tax relief incentives for parents, which he said will “further encourage the employment of women and respond to structural, long-term distortions”.

On the matter of businesses, he said the government plans to completely abolish deemed dividend distribution payments and “significantly reduce” the withholding tax on the distribution of actual dividends from 17 per cent to five per cent.

At the same time, he said corporation tax will increase from 12.5 per cent to 15 per cent, bringing Cyprus into line with European Union requirements.

These plans will soon be brought before cabinet for approval, before being submitted to parliament, where an extended debate can be expected.

Business news website InBusinessNews reported that the government aims for the reform to be fully implemented in 2026.

The business tax changes, he said, “demonstrate our clear will to strengthen the country’s productive fabric and enhance our international image and credibility, which, for our government, is a top priority”.

“The goal remains to invest in innovation, quality, and credibility, so that Cyprus becomes a pole of attraction for quality investments and of course a pillar of security and stability in the wider eastern Mediterranean region,” he said.

He also said his reforms are “of particular political, economic, and social importance in a Cyprus which is changing”, and that they will “ensure a fairer distribution of income, which limits social inequalities, and which strengthens economic and social cohesion in our country.

“A Cyprus which is changing with a tax system which is more efficient, fairer, more adapted to modern needs.”

He also extolled the virtues of the current state of Cyprus’ economy, saying it has one of the highest growth rates in the Eurozone, a “strong” fiscal surplus, and a steady reduction in public debt.

“The responsible fiscal policy that is being followed is bringing results and allowing the state to make targeted social interventions. And all this in the midst of two wars and with the strong economies of Europe being placed under supervision,” he said.

He added that “taking into account all the challenges, and there are many, internal and external, we are moving forward with determination, with a clear plan, in our country’s tax transformation, strengthening our economy’s competitiveness and its further development”.

He went on to say that the reforms “reflect in practice our political ideology as a government, that of social liberalism, but also the imprint of our human-centric approach”.

“Moreover, tax policy is not a neutral technical process, it is first and foremost a political act, a political decision which reflects the compass of social justice and development. The aim, therefore, is to strengthen the real economy and the competitiveness of Cypriot businesses which create well-paid jobs and, above all, strengthen people’s disposable income in a time of many challenges.”