Filenews 6 December 2024- by Nick Sargen

Shortly after the start of the U.S.-China trade war in early 2018, I spoke at a conference in Shanghai where I gave my assessment of how long it would last. In short, I thought that was the starting signal of a long conflict.

The trade war began shortly after Robert Lighthizer's report, released in March 2018, found China engaged in unfair trade practices. China has had a large trade surplus with the United States since it joined the World Trade Organization in late 2001. Meanwhile, a large number of manufacturing jobs were lost in the United States, Washington accused Beijing of looting intellectual property rights and heightened national security concerns.

Over the next year and a half, the US gradually imposed tariffs on goods imported from China. In the end, tariffs were imposed on about 50% of Chinese goods. The highest duty rate was set at 25% and the average was 20%.

Some analysts believed that the "trade war" would have a negative impact on the Chinese economy, but these were slow to appear. Ahead of the "second trade war," experts see much deeper implications.

One reason is that President-elect Donald Trump is considering imposing much higher and comprehensive tariffs than last time. On the campaign trail, he pledged to raise tariffs on all imported Chinese goods to 60 percent, and upon his election to the U.S. presidency announced that he would impose an additional 10 percent tariffs.

Financial markets have not reacted so far, as most investors see Trump's threats as a bargaining chip.

But economists polled by Reuters agree that the United States will impose an additional 40 percent tariff in early 2025. In this scenario, respondents "see" that the growth rate of the Chinese economy will slow by 0.5%-1% in 2025.

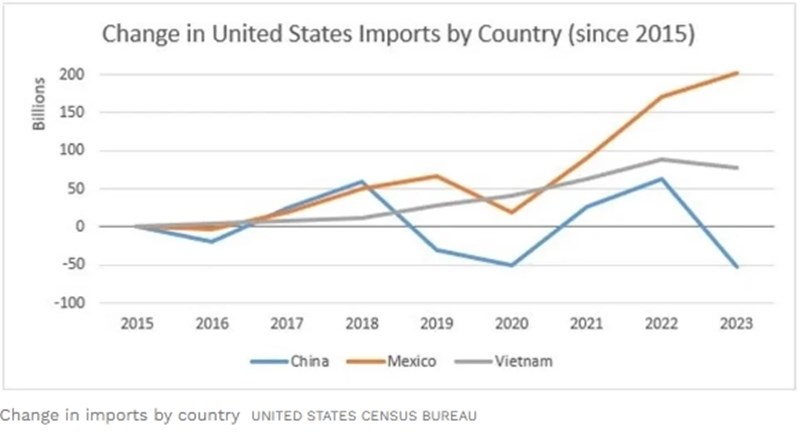

Another reason is that China has managed to circumvent some of the tariffs in place by redirecting products exported to the U.S. through infrastructure in Mexico and Vietnam. Thus, while imports of Chinese goods into the US fell by about EUR 110 billion. From 2018 to 2023, imports from Mexico and Vietnam increased by about $130 billion. and $70 billion. dollars respectively. (see diagram).

Chinese exporters can turn to new markets and set up offshore factories, but Trump has vowed to end those manoeuvres. It has warned of imposing additional tariffs of 25 percent on imports of products from Mexico and 100 percent to 200 percent on electric cars produced by Chinese companies in Mexico and exported to the United States.

Another important difference is that the Chinese economy has weakened compared to its image when the trade war began, as there have been several adverse developments: the real estate crisis, the fallout from Beijing's one-child birth control policy, and the sluggish post-pandemic response.

The Chinese government recently announced fiscal measures to stimulate the economy, but the impact so far has been lukewarm. Some analysts believe this picture undermines China's bargaining power.

However, Beijing does not seem willing to accept US "trade strikes" without retaliating.

According to the Financial Times, China has enacted "tough" laws, since Trump's first term, that enable it to react to measures taken by other states against it. In particular, it can blacklist companies, impose sanctions and block U.S. access to critical supply chains.

Export control legislation enables Beijing to leverage its global dominance of resources such as rare earths and lithium, vital for modern technology, to limit other nations' access to them. China announced this week that it was banning the export of certain rare minerals to the U.S. — a day after the Biden administration "made it difficult" for China to access advanced U.S. technology.

These moves signal a possible escalation of the "trade war". For example, the chairman of the House of Representatives' Special Committee on the Chinese Communist Party John Moolenaar introduced a bill in November that would revoke China's PNTR (Permanent Normal Trade Relations) status.

A recent study by the Peterson Institute found that ending China's PNTR regime would accelerate inflation in the U.S., while its GDP would fall in the short term.

According to the study: "The stock market would fall, with the agricultural, manufacturing and mining sectors coming under the strongest pressure."

The next phase of the U.S.-China trade war may be more damaging — compared to the previous one — for both camps. In this case, financial markets will be more volatile as investors realize that there are no winners in a trade war between the world's two largest economies that is more disruptive than before.