FIlenews 12 December 2024

This article is written by the Bloomberg editorial team

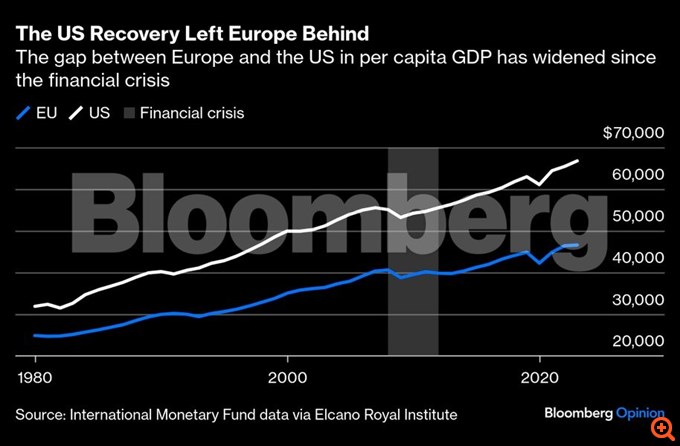

Eurozone growth lags behind the United States, with GDP per capita in most of the bloc compared to poorer U.S. states. This makes Europe particularly vulnerable to tariffs brandished by President-elect Donald Trump. Although European Union leaders will be tempted to respond simply with retaliation against U.S. products, a-for-tat trade war helps no one. The best option for the EU is to put its own house in order.

"We have to be clear about the fact that today, our Europe is mortal. He may die," French President Emmanuel Macron warned earlier this year. Maybe he exaggerated, but the threat is real. The prolonged slowdown in productivity is adding to Europe's problems and jeopardising its priorities. As former European Central Bank chief Mario Draghi put it in his recent report: "This is an existential challenge."

Trump will exacerbate this challenge. To prepare for the difficult road ahead, Europe's leaders will need to focus on three problems.

The first is that the EU's single market is not so single. In theory – and often in practice – goods, services, capital and labour circulate freely in 27 countries. But according to one estimate, 10% of potential GDP is left untapped due to frictions within the single market. The International Monetary Fund calculates that these obstacles amount to a 44% tax on manufacturing and 110% on services. Member States must realise that they have a mutual interest in reducing these obstacles.

A second challenge is Europe's notorious bureaucracy. If anyone needs a Department of Government Efficiency, it is Brussels, although governments often burden EU rules with their own obstacles (so-called gold plating). Draghi's report noted that while the U.S. has enacted about 3,500 federal laws and about 2,000 resolutions since 2019, multitaskers in Brussels have passed 13,000 laws of all kinds. More than 60% of EU companies recognise that these rules stand in the way of investment.

For example, the EU has around 100 technological laws implemented by more than 270 regulators. This has created a fragmented and regulatory regime that further strengthens US tech giants – which can afford compliance costs – at the expense of their potential European competitors. Of the 147 unicorns founded in Europe between 2008 and 2021, 40 have since moved abroad. Germany's SAP SE, the EU's leading technology company, is 50 years old. Brussels must at least accept that its bureaucracy comes with consequences – and focus, as Draghi says, on "fewer and better regulations".

Finally, better access to capital is essential. While U.S. businesses get about 75 percent of their funding through capital markets and a quarter from banks, EU businesses rely on banks for more than 70 percent of external funding. The problem is that EU banks tend to park their capital in stable companies with a high proportion of tangible assets. A recent ECB report found that banks prefer firms with low productivity, particularly in real estate, wholesale and retail.

The EU's decade-long effort to create a comprehensive capital markets union has progressed too slowly. Different rules in its member states – covering important issues such as securities trading, bankruptcies and investment taxation – hinder the efficient allocation of capital. A single rulebook for businesses operating cross-border (also known as the "28th regime") could provide a significant boost to productivity and innovation.

Whatever tariff Trump imposes, Europe has done too much to hamper trade and investment within its borders. No additional measure can replace the efficiency of removing some domestic barriers.

Editing – Performance: Lydia Roumpopoulou