Filenews 29 November 2024

Elon Musks's rise to the top of US politics as an "efficiency czar" is causing deep concern in Europe, and not just because of his abusive social media rants against Brussels regulators. Former German Chancellor Angela Merkel called the "union" of Elon Musk and Donald Trump extremely worrying, while referring to spikes in Musk's dominance in the space industry. The anguish is justified – but accusations alone are not enough.

Musk's SpaceX, worth $210 billion. dollars, is extremely powerful, even more so than his tweets. The company's multipurpose missiles have effectively monopolized the commercial launch services market once led by Europe. Starlink's 6,000 satellites offering fast internet anywhere on the planet have changed the course of the war on Ukraine's battlefield – marked by heavy use of drones. Officials fear the billionaire's conflicts of interest will exacerbate a dangerous addiction: At a panel in Paris last week, top German official Andreas Mundt addressed Musk's influence over Starlink and urged tech regulators to act boldly, saying it was "unacceptable" for a man to exercise state powers.

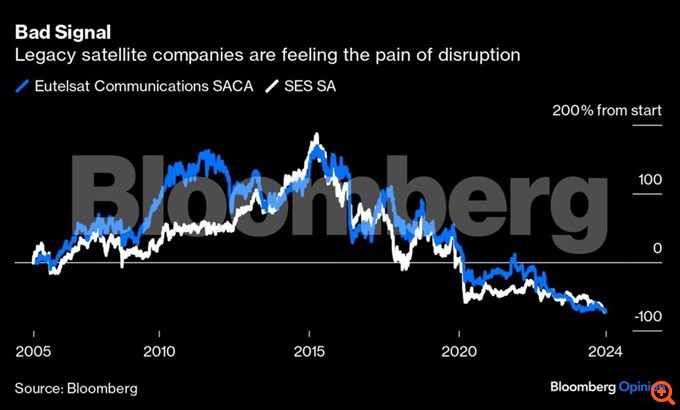

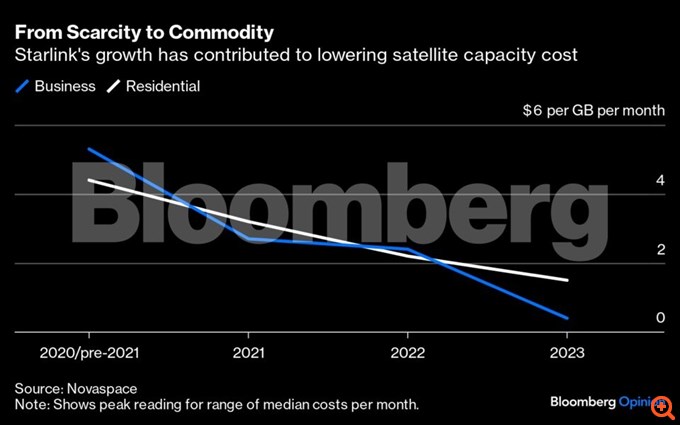

However, Musk's successes in space have also been helped by European failures in adaptability and competition. SpaceX's rivals have some blind spots: Europe doesn't have a reusable rocket after deciding against the technology a decade ago. Legacy businesses like satellite TV are suffering in the age of on-demand streaming, like Netflix, while markets like shipping and airlines are lured by Starlink's more affordable and easy-to-install Wi-Fi kit. The impact of falling prices continues, even amid a wave of growth-oriented mergers: Luxembourg-based Intelsat, which is being acquired by SES SA, posted a 9.4% drop in third-quarter revenue, with a 13.7% drop in in-flight revenue. Shares of Paris-based Eutelsat Communications SACA, which merged with Britain's OneWeb, fell to a 19-year low.

As Europe vacillates over how to catch up, Starlink is adding new wins to its base of 4 million subscribers. Air France-KLM – which is partly owned by the French government – announced in September a deal with Starlink to offer high-speed Wi-Fi on its flights from next summer. That same month, Starlink announced a deal with top U.S. customer United Airlines Holdings. Novaspace CEO Nathan de Ruyter believes Starlink is able to improve its product as it launches more satellites.

While being good at building rockets is clearly not a reason to allow undue power to accumulate in one's hands, Starlink is a formidable product, and the battle for Europeans should be focused on promoting a viable domestic alternative – especially considering that the owner of the Amazon.com Jeff Bezos is the closest alternative to Musk. Complaints from people like Merkel can start a wake-up call – provided the onus is on innovative technology, not just regulation.

More government spending is coming through the belated IRIS² project, and new startups are being encouraged to develop their own missiles. At a recent defense industry meeting, I saw a European surveillance technology based on Starlink combined with a backup system, which likely continues pressure to fund alternatives not tied to Musk. If a European Starlink ever appears, it could level the playing field.

Hopefully, the Trump and Musk duo will also convince wary Europeans to emulate another factor that determines SpaceX's success: deep, large capital markets capable of financing and expanding risky ventures. European Central Bank chief Christine Lagarde said last week that the European Union's "undeniable" technological lag and looming trade tariffs made the capital markets union imperative. Perhaps a bigger concern than that of Musk's geopolitical power is Europe's tendency to act only in crisis mode — another thing Merkel may know something about.