Filenews 19 July 2024 - by Lionel Laurent

In a sign of developments coming for Europe, the place to watch this week is not Blenheim Palace or the European Parliament, but the Republican National Convention in Milwaukee. There, Donald Trump in the bandage and his prospective partner J.D. Vance open their cards: freeze or end the war in Ukraine, intensify competition with China, protectionism and restrict immigration. It is time for Europeans to prepare for the impact of a transatlantic shock on the system – a Trump 2.0 with added hostility.

The carving up of Ukraine as part of a deal with Russian President Vladimir Putin would usher in a new world for the European Union, which is far from ready to integrate Kiev or fulfil security commitments without U.S. support. Pressure to align with the U.S. over China, while already tough under the Biden administration, would hit top EU companies such as Dutch ASML Holding NV and Germany's Volkswagen AG. The trumponomics playbook of prioritizing domestic demand at the expense of allies could be as dramatic as Nixon's shock in 1971 of abandoning the gold standard and raising tariffs, economist Bruno Colmant estimates.

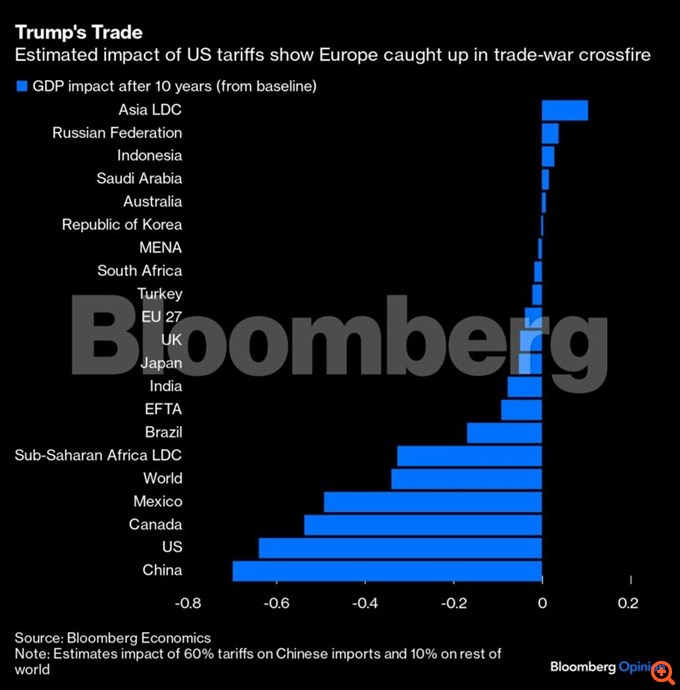

In an ideal world, given Trump's rise in the polls and Vance's views, Europe would have a response ready — beyond the hope that the economic impact of trade tariffs will prove manageable, as the chart above shows. After all, this is a bloc that has gone through a series of crises over the past decade and wants to be taken seriously as a superpower rather than a "vassal" of the US, as French President Emmanuel Macron once put it.

Yet in Brussels there is still something between denial and rejection, from loyalty to Western solidarity to optimism that a mixture of appeasement and countermeasures will be enough to tame Trump. Or the view, "We managed Trump once, we can manage him again."

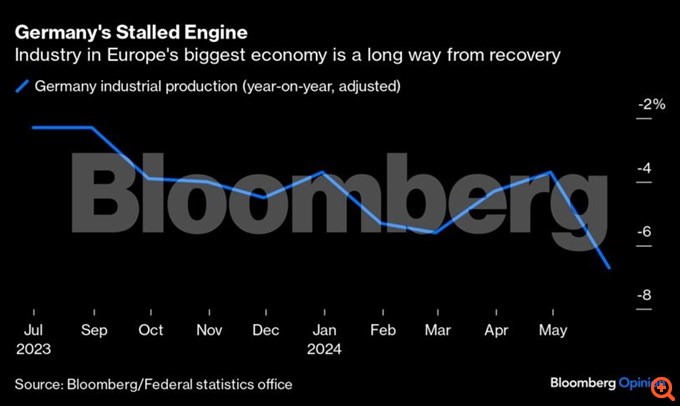

That is not enough. Europe, bonded more closely since Trump first appeared on the world stage, is increasing spending on hard power. But it is weaker elsewhere. Politically, it is dispersed: France has no prime minister after complicated elections, Germany's fragmented coalition fails to lead, and Hungary's Viktor Orban is on a diplomatic tour that includes meeting with Putin (and Trump). Economically, eurozone growth is weak and its trade dependencies are greater. And while the bloc has become a pioneer in bureaucracy and regulations to protect its consumers, it has nothing that can compete with the biggest U.S. tech companies. "Europe is less naïve than it was in 2016, but more vulnerable," argues Eric Maris of the European Policy Centre.

The deep divisions between Berlin and Paris are not helping. Germany's export-based model has already suffered huge blows in the wake of Covid-19 and the war in Ukraine — Trump's tariffs will cost its economy more than 1% of GDP by 2028, according to a March survey by the IW institute. But instead of embracing French-led ideas such as more integration and investment to strengthen the bloc, Germany seems more interested in defending its commercial fields and is indifferent to France's budget deficit. Economist Lars Feldt, an adviser to Germany's finance minister, speaks of fiscal discipline instead of fiscal revolution.

As Macron's drive for a more autonomous EU is likely to weaken as his presidency enters its final phase, the likelihood of a messy strategy increases. Such an approach could combine ever higher targets for NATO defence spending with trade rewarding measures. But given the risk of a serious Trump security shift away from Europe, a structural mindset shift would be much better. Europe needs to increase its domestic defense industry to keep pace with Sino-American competition, more joint spending to boost pan-European investment, and an overhaul of its single market to encourage innovation. Good luck in getting all this done by 2025.

The last bastion left is the euro. With the still-untested Keir Starmer taking over as Britain's prime minister and Brussels on hold as a new Commission prepares to be formed, it may be time to turn to Frankfurt and the European Central Bank's toolbox. Trump has summed up his economic plan with catastrophic clarity: low interest rates, low taxes, higher tariffs. The ECB should be prepared to face further interest rate cuts to support its economy and exports, even at the risk of more expensive imports such as energy. If Europe cannot be strong, let the euro at least be weak. It's a painkiller, not a drug — but every little painkiller will help in the run-up to Trump 2.0.

Performance – Editing: Stathis Ketitzian