Filenews 10 July 2024 - Bloomberg Opinion Editorial Team

The European Union faces a daunting challenge for the next five years: putting public finances in order while pooling the investment needed to tackle a number of common challenges.

This task will require a level of discipline and cooperation that is anathema to hard-right populists, who, after their strong showing in the last European elections, will occupy a quarter of the European Parliament by 2029.

The combined blows of the global coronavirus pandemic, the war in Ukraine and Russia's instrumentalisation of energy supplies have hit governments' finances.

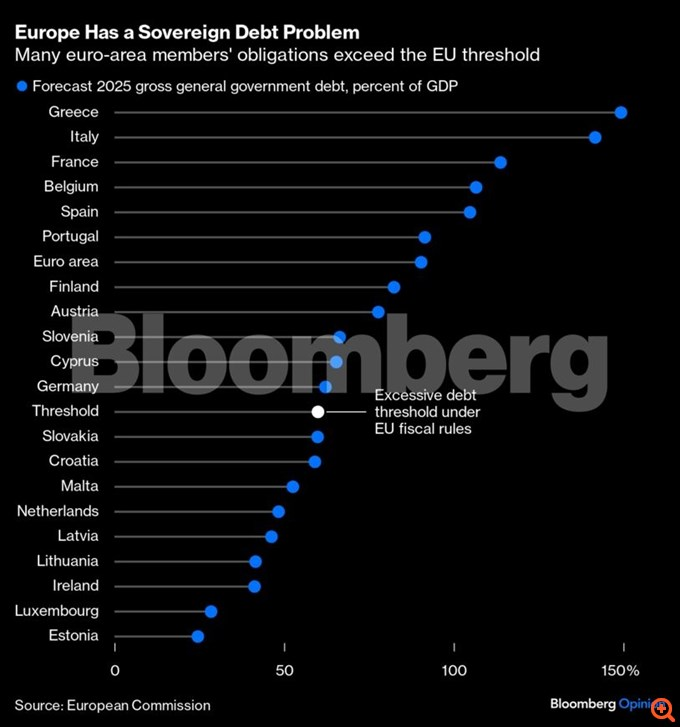

Total eurozone public debt is forecast to exceed 90% of GDP in 2025, up from around 84% before the pandemic and 66% before the 2008 financial crisis, on a path that threatens to undermine the common currency. France and Italy in particular – with one of the region's highest debt-to-GDP ratios – must reduce budget deficits or face sanctions under new EU fiscal rules.

Europe has a sovereign debt problem

Meanwhile, the EU desperately needs funds for projects that will benefit the entire region. The green transition alone will require over €5 trillion in public and private investment over the next five years. Strengthening communication infrastructure, boosting defense capabilities, increasing military production and supporting Ukraine will cost hundreds of billions more.

How can Member States pursue these objectives and at the same time restore fiscal prudence? One answer lies in a deeper union. A united Europe has much greater economic firepower. It can support a budget large enough to meet common investment needs. By consolidating its capital markets, it can unlock trillions of euros in additional private investment.

Europe's leaders have taken some steps in the right direction. In 2020, they set up a €750 billion joint fund to support the recovery of the states most affected by the coronavirus pandemic. Although some have criticized the program as wasteful, early evidence suggests that Italy – by far the largest recipient of the funds – has indeed boosted potential growth by reinvigorating much-needed reforms to the justice system, public procurement and public works.

Right-wing populists will make this progress more difficult. Most are radically opposed to a stronger union (with the possible exception of defence funding). Italian Prime Minister Giorgia Meloni has already worsened the country's finances to boost home renovation. France, too, may find itself at loggerheads over the budget with EU officials, now that President Emmanuel Macron's snap election has empowered populists on the left and right.

Without a doubt, the rise of the far right reflects popular discontent with bureaucrats in Brussels. However, issues such as climate change and the economy remain among Europeans' top concerns, and centrists still have a majority in the European Parliament.

If they fail to address these challenges, voters will hold them responsible. If they show the leadership needed to advance the European project, to achieve a resilient and prosperous union, they have a much better chance of keeping extremists at bay. They should seize this opportunity as far as possible.

Performance – Editing: Stathis Ketitzian