Filenews 16 July 2023 - by Charalambous G Prountzos

The aim of any electricity market is to provide consumers with sufficient electricity at an affordable price.

Low electricity prices strengthen the competitiveness of businesses and the disposable income of households.

Competition in the electricity market is not an end in itself and there can be no real competition unless it results in better services being offered at the cheapest possible price.

If we exclude periods of abnormal market conditions (e.g. the period after Russia's invasion of Ukraine), when production fuel prices skyrocketed, it is clear that Cyprus is one of the EU countries with the most expensive electricity costs.

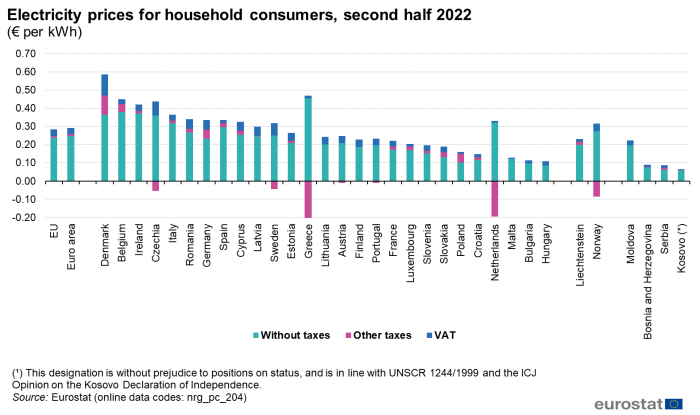

In the graph below, concerning household consumers for the second half of 2022, sourced from Eurostat, one can identify Cyprus in ninth place in the EU in electricity costs.

This period favours Cyprus comparatively, due to the greater increase in electricity costs in the vast majority of EU countries. Previous tables showed Cyprus in a worse position.

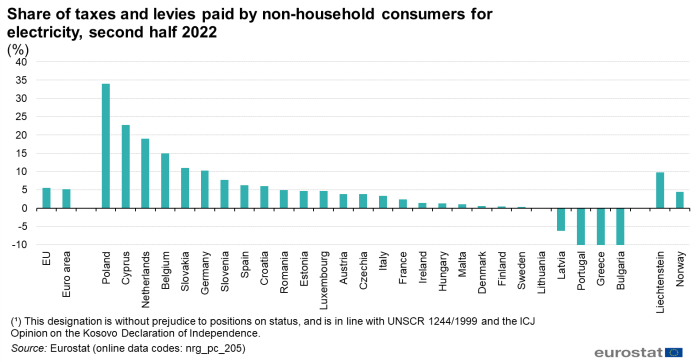

Approximately the same trend is found among non-domestic consumers. But there is another interesting element, which has to do with the percentage of taxes and fees in the cost of electricity for this category of consumers.

In this category, Cyprus is in second place in the EU, behind only Poland. The rate of taxes and fees in this category is close to 23% of electricity costs, with the EU average standing at just over 5%.

The graphs for total electricity costs and tax rates on total costs show two things:

1. The total burden on households and businesses from an unbearable, uncompetitive, electricity cost

2. The exercise of the government's fiscal policy through electricity bills in an unacceptable manner.

Traditionally, the high cost of electricity was considered the responsibility and responsibility of EAC as a vertically integrated, monopolistic public company. For previous years this might have been true. Over the past five years, however, this argument has been fundamentally shaken. And it needs to be challenged more strongly if we are to achieve market and cost rationalisation.

First of all, let us mention the obvious, that the supply market now operates private participants, who receive and channel the energy they manage under bilateral contracts. Many of EAC's tariffs are regulated due to its dominant position. However, this does not apply to private suppliers.

Why don't they drop prices?

When asked why private suppliers do not charge low prices to their non-household counterparties, there are two answers:

1. They have no incentive to do so, since the main market player is "locked" in a very high cost of purchasing electricity (generation) and unable to supply profitably at lower prices. Therefore, with a relatively small discount (eg 10%) from the corresponding EAC cost, private suppliers can easily penetrate the market.

2. Because private suppliers themselves have very limited power generation at their disposal to buy and manage, exclusively from PV systems, with producers from such systems selling at high prices to suppliers.

If the first reason is the result of commercial and pricing policy, the second reveals structural problems of the market, which were partly analyzed in my previous article in Phileleftheros. For these, the main responsibility lies with the executive power and mainly with the Ministry of Energy and secondarily with CERA and TSOC.

In particular, a significant percentage of existing RES supply electricity to EAC at a fixed tariff (Euro 0.166 per kw/h for wind and various tariffs for PV).

If we exclude relatively small production capacity of PV systems that sell at a particularly high price, the vast majority of these producers currently sell to EAC significantly below the cost of avoiding EAC Generation, contributing to the reduction and not the increase of electricity costs, as many piecemeal believed.

They also help EAC to become profitable, since they give it a higher profit margin, serving its sustainability.

A large part of the remaining RES capacity (almost exclusively consisting of PV) is contracted with private suppliers.

The two main private supply companies also have at their disposal production capacity from related or otherwise related companies. However, this is limited in terms of overall market sizes.

The inability to quickly license, develop and mainly connect RES projects has begun to lead the market to serious distortions, with consumers and EAC itself paying the bride for the mistakes of the previous decade, which brought us to this point.

In particular, there is a de facto limited production available, resulting in producer prices being pushed upwards. On the other hand, private suppliers, in an effort not to be locked into long-term contracts with high market prices, enter into short-term purchase contracts or resort to adjustment and exit clauses that may affect private producers and their profitability in the long run.

The cost of production from new renewable energy systems (mainly PV) has also increased significantly, due to inflation, supply chain issues and huge demand.

The real cost of producing EAC from conventional fuels is not expected to decrease anytime soon.

These costs largely consist of personnel costs, which are inelastic, and fuel costs, which are poorly managed and have vested economic interests.

I am not convinced that the arrival of natural gas in Cyprus (officially in 2024, more realistically in 2025) will reduce electricity prices for consumers.

It is a fact that the use of natural gas will reduce the burden of pollutant costs, which reached €250 million per year, with increasing trends. However, natural gas infrastructure requires hundreds of millions of investments from DEFA, ETYFA and EAC (e.g. conversion costs) that will be repaid through consumer bills.

What is required to be done

In order to reduce electricity, integrated planning is required in all sub-markets of the electricity and gas market, since in the future the two markets will act as communicating vessels.

Especially:

1. Indirect fiscal policy conducted through electricity bills leading to higher total electricity costs for domestic and non-domestic consumers must be designed from scratch. The burden of fees and taxes on electricity tariffs should be close to the EU average.

2. The available production of RES must be increased. This cannot be done without a substantial upgrade of the transmission and distribution network and without the urgent construction and operation of storage systems.

3. The submitted and approved Plan of the Republic of Cyprus for the Recovery and Resilience Fund should be amended and an amount beyond Euro 100 million should be added to it. for the installation of a central storage system. At the same time, promote decentralised storage by the private sector with proper procedures.

4. EAC to remain outside the RES production market as CERA's Regulatory Decision. in exchange for the assignment to EAC or a Public Private Partnership (PPP) of the management of the central storage system and the possibility to purchase RES production from EAC Supply through tenders for a capacity of up to 100MW

5. Remove the funny 150kw cap on virtual net billing plans.

6. To be granted by the Regulator a transitional period of 6 months (1/1/2024 – 31/6/2024) to EAC with reasonable binding application and connection times for net metering and net billing. In case of failure of EAC to meet the examination and connection time targets, the responsibility to be removed from EAC

The above package will be analyzed in a later article.

Lawyer – Managing Partner Prountzos & Prountzos LLC

c.prountzos@pplegal.com.cy