BBC News 11 May 2022 - by Lora Jones

At a glance, Russia has so far been able to fend off an economic collapse following its invasion of Ukraine.

It has been hammered by sanctions introduced by Western countries since February.

The initial shock forced the stock market in Russia to close temporarily and saw people queueing up at cash machines, worried about their savings.

Its interventions included limiting the amount of money people could transfer abroad, as well as forcing firms that export things to convert 80% of their overseas incomes into Russian currency.

The country has also managed to avoid defaulting on its foreign debts.

President Putin has insisted that the West's "economic blitzkrieg" has failed.

But Elina Ribakova, deputy chief economist at the Institute of International Finance, says these "superficial" indicators "don't mean much to real life".

Russian steelmakers, chemical manufacturers and car companies are already feeling the brunt of sanctions aimed at crippling President Putin's war effort.

A recent survey of more than 13,000 businesses by Russia's central bank revealed that many are experiencing problems bringing goods such as microchips, car parts, packaging, or even buttons, into the country as a result.

Shortages of raw materials or parts are forcing some firms to temporarily close factories or to look elsewhere.

Japanese car-maker Toyota, for example, stopped imports of cars to Russia and suspended operations at its plant in St Petersburg in March, citing "supply chain disruptions" linked to the conflict.

BlueBay Asset Management economist Timothy Ash says that overall sanctions have been much more aggressive than many had expected.

"I think the longer-term impact will be devastating," he tells the BBC, adding that "Russia being cut out of Western supply chains because it is an unreliable partner" will push the country into recession.

Even the Bank of Russia has acknowledged that as companies look for different suppliers, deal with boycotts by shipping companies or fail to get hold of the technology they need, the country will face a period of "reverse industrialisation".

"The reality is, Russia will have limited access to financial markets, lower growth, lower living standards and a higher cost of borrowing," Mr Ash adds.

Of course, that impact spills out.

Many ordinary Russians, Ms Ribakova says, are "living in a grey area", particularly when it comes to job security.

"A lot of people have no idea what's going to happen... They might still be going out to restaurants, going to work and not seeing much of a change yet because the companies they work for are unclear about their plans."

Symbolic Western brands, such as McDonald's and Levi's, continue to pay thousands of Russian employees, despite halting operations in the country.

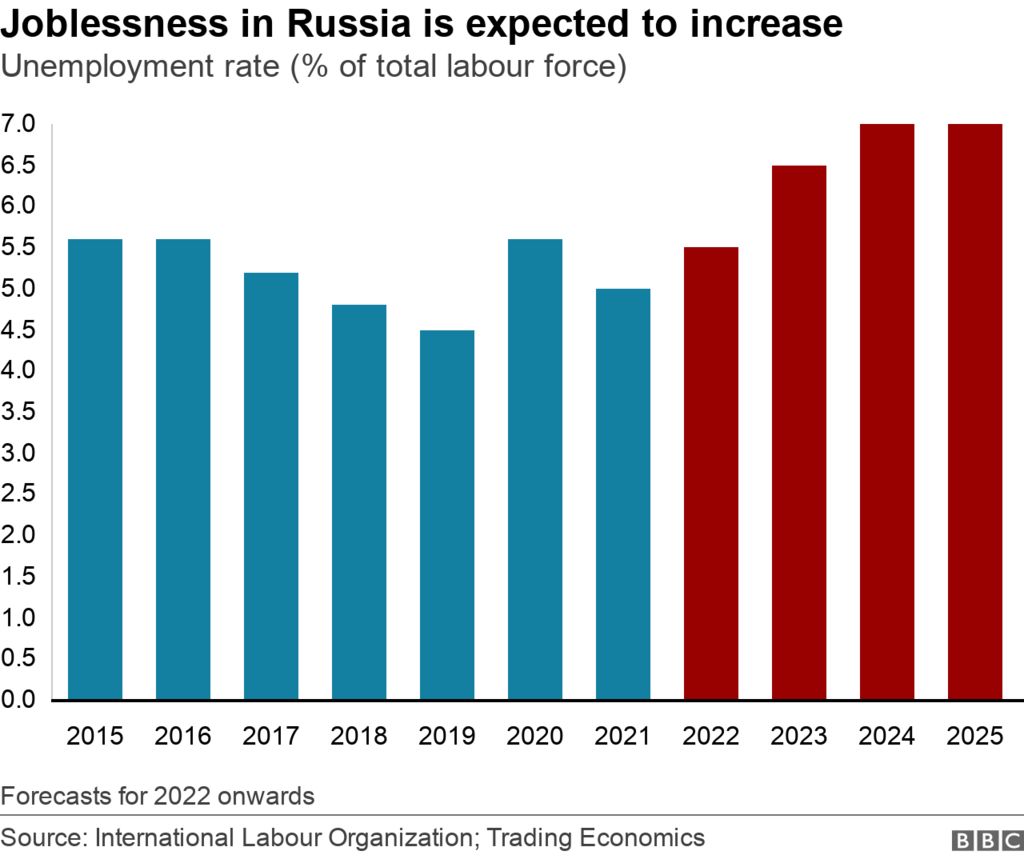

But there are fears that job losses will start to mount as hopes fade that the war will come to an end soon.

Moscow's Mayor Sergey Sobyanin warned in April that about 200,000 jobs were at risk in the city alone, while Trading Economics forecasts that the unemployment rate across Russia could jump to 7% by 2024.

And there has already been a big exodus of IT workers and other professionals, in what Mr Ash describes as a "brain drain".

Several consultancies have pulled workers out of the country, while reports by the Latvia-based independent Russian news website Meduza suggest up to 5,000 Yandex employees left Russia, with some citing concerns over the tech giant's censorship of war-related content.

For those that remain, making ends meet is a big worry.

"There's this idea that Russians are used to difficult conditions, but they have lived through 20 years of relative prosperity," Mr Ash said. "They've known the good life."

The TV set vs the fridge: How ordinary Russians are coping

Anastasiia Stognei, business reporter, BBC Russian

Olga, 30, is a Moscow bank employee. She is trying to stick to her pre-war standards of living but it is increasingly difficult.

Like many Russians, she has to ask a friend living in Europe to pay for her Netflix and Spotify, after Visa and Mastercard left Russia.

Earlier this month, she booked a flight to go on holiday to Turkey - one of very few foreign destinations still open to Russians.

Before the war a plane ticket would have cost her 15,000 roubles (£170). Now she's had to pay 55,000 roubles (£640).

Olga is praying it will be possible to update her iPhone and MacBook laptop when outside of Russia - Apple has also ceased operations in the country.

For 79-year-old Lyudmila from Voronezh, a city 500km south of Moscow, basic necessities have become a lot more expensive. "I go to a market once a week. Every time things get more and more pricey. Last time milk went up by five roubles, tomatoes by 10."

Dmitry, 33, is a masseur from the small Siberian town of Rubtsovsk. Before the war he had a good life, spending around 300 roubles (£3.50) a day. "Sausage, bread, go to the banya [Russian sauna] once a week with friends."

Since 24 February, when the war began, his expenses have jumped by 50%.

Despite economic difficulties, Dmitry supports the war. He says some of his friends complain about the prices and also that it is no longer possible to watch any Western blockbusters in cinemas.

Despite everything, most Russians still firmly support this war. The TV set, filled with official propaganda, is still more powerful than an empty fridge.

While there were reports of shortages of things like cooking oils around the outbreak of the war, supermarket shelves are reportedly well-stocked now - but items are pricier.

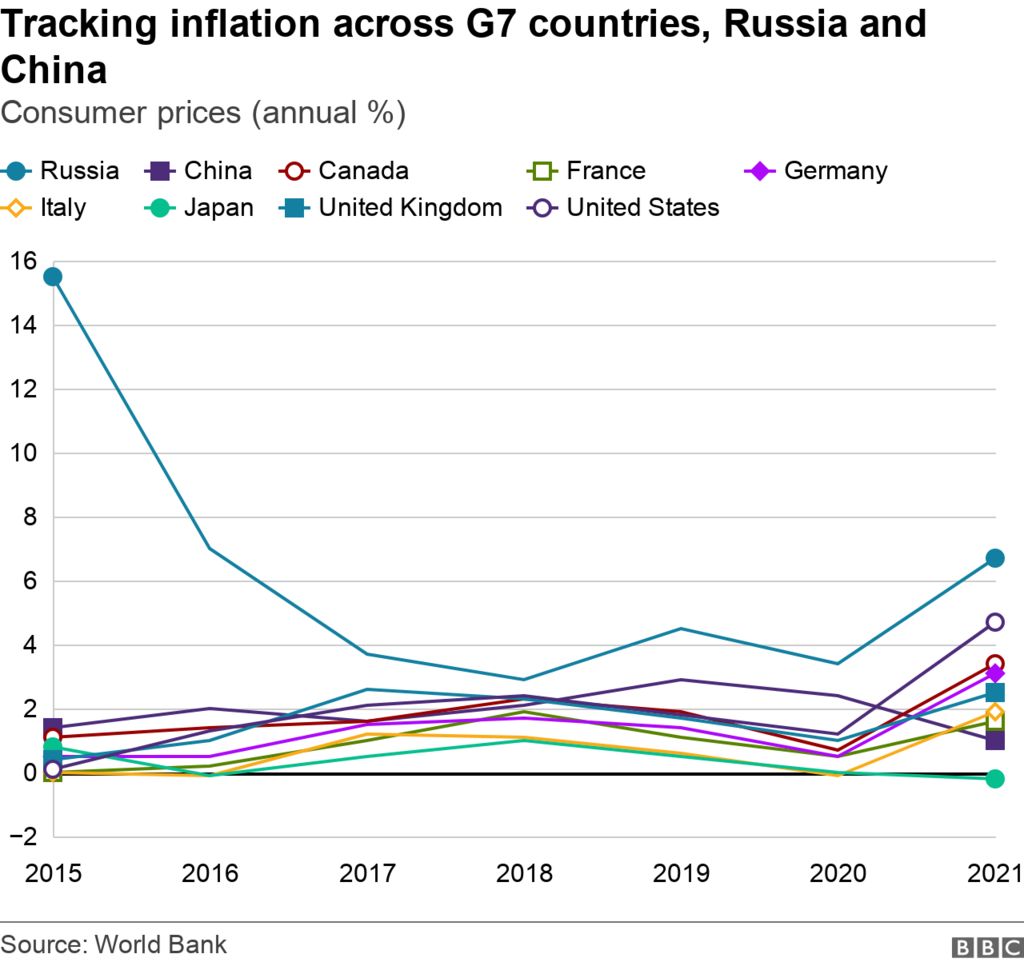

Many countries are grappling with soaring prices in the wake of the pandemic.

But in the face of a shrinking economy and supply chains being disrupted, economists expect that inflation, which tracks how the cost of living changes over time, could hit at least 20% in Russia in 2022.

Mr Ash and Ms Ribakova recall friends struggling to get hold of heart or thyroid medicine, but say it is the poorest Russians who will notice the increasing cost of living the most.

President Putin has pledged that pensions and unemployment benefits for those struggling would rise in line with inflation.

And the Russian government does have its own financial lifeline, even with unprecedented levels of sanctions in place. It is still able to sell a lot of oil and gas - a key pillar of its economy.

According to figures from Russia's central bank, it exported goods and services worth $58.2bn (£47.2bn) more than the value of its imports in the first three months of 2022 - with numbers pushed up by higher energy prices.

Although the US has announced a ban on Russian energy imports, Europe is still divided on how to wind down dependence on Russian supplies.

Europe gets about 40% of its natural gas from Russia, which is also the bloc's main oil supplier, but some countries are more dependent on Russian fossil fuels than others, so sudden supply cuts could have a big economic impact.

"There is no doubt that Europe will have a difficult few years going away from Russian oil and gas, but this is much worse for the Russian economy, which will suffer in the long-term," Ole Hvalbye, an energy analyst with the SEB bank, says.

While Russia might have enough of a financial cushion to provide subsidies to the poorest in the short-term, as well as to protect the rouble, Mr Ash says the long-term view is more uncertain.

But he adds: "Whatever happens, whether an oil embargo is introduced in six months or a year... it will be a severe hit" for an economy isolated from the West.