in-cypru 5 May 2020 -Bouli Hadjioannou

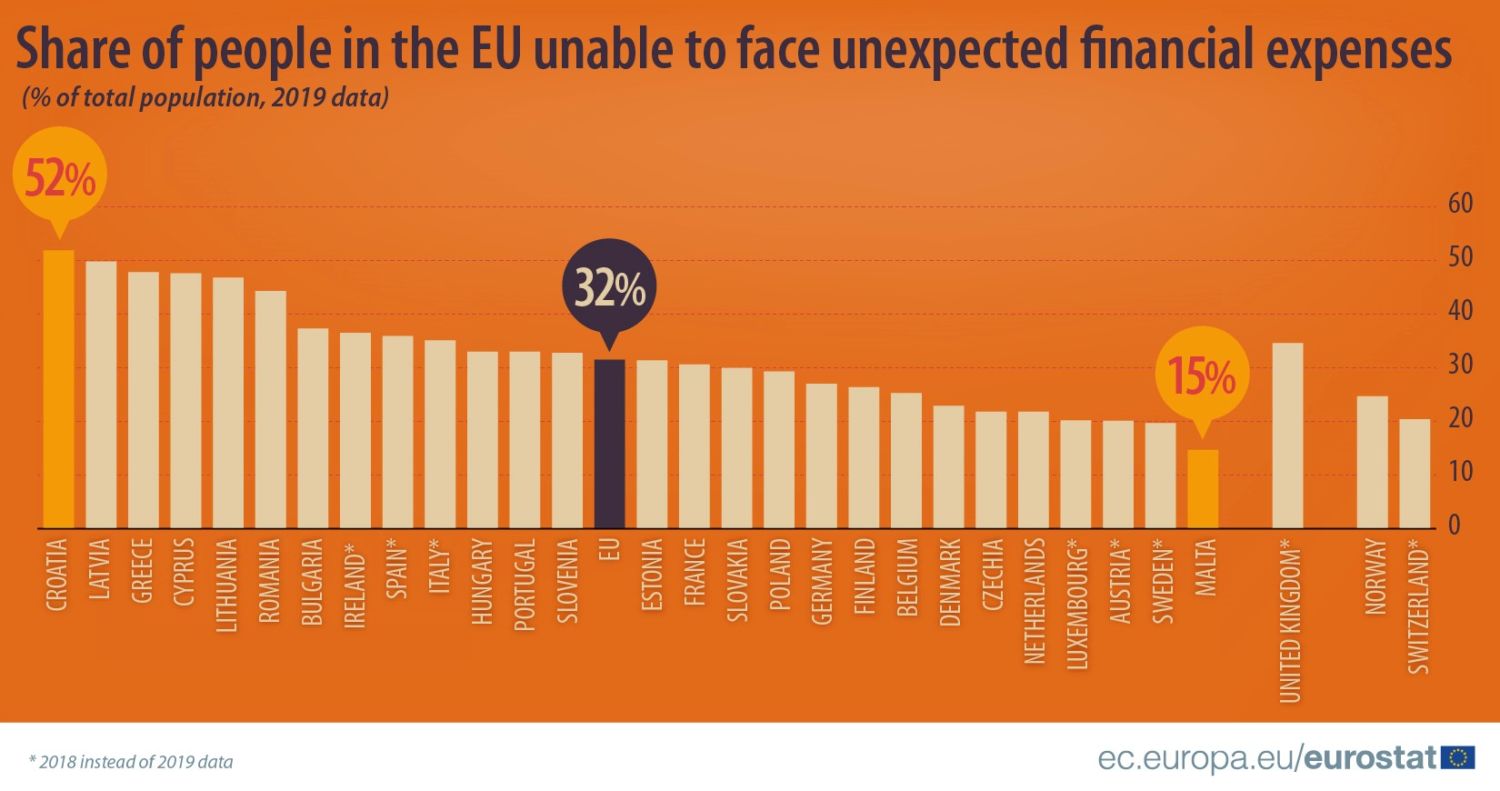

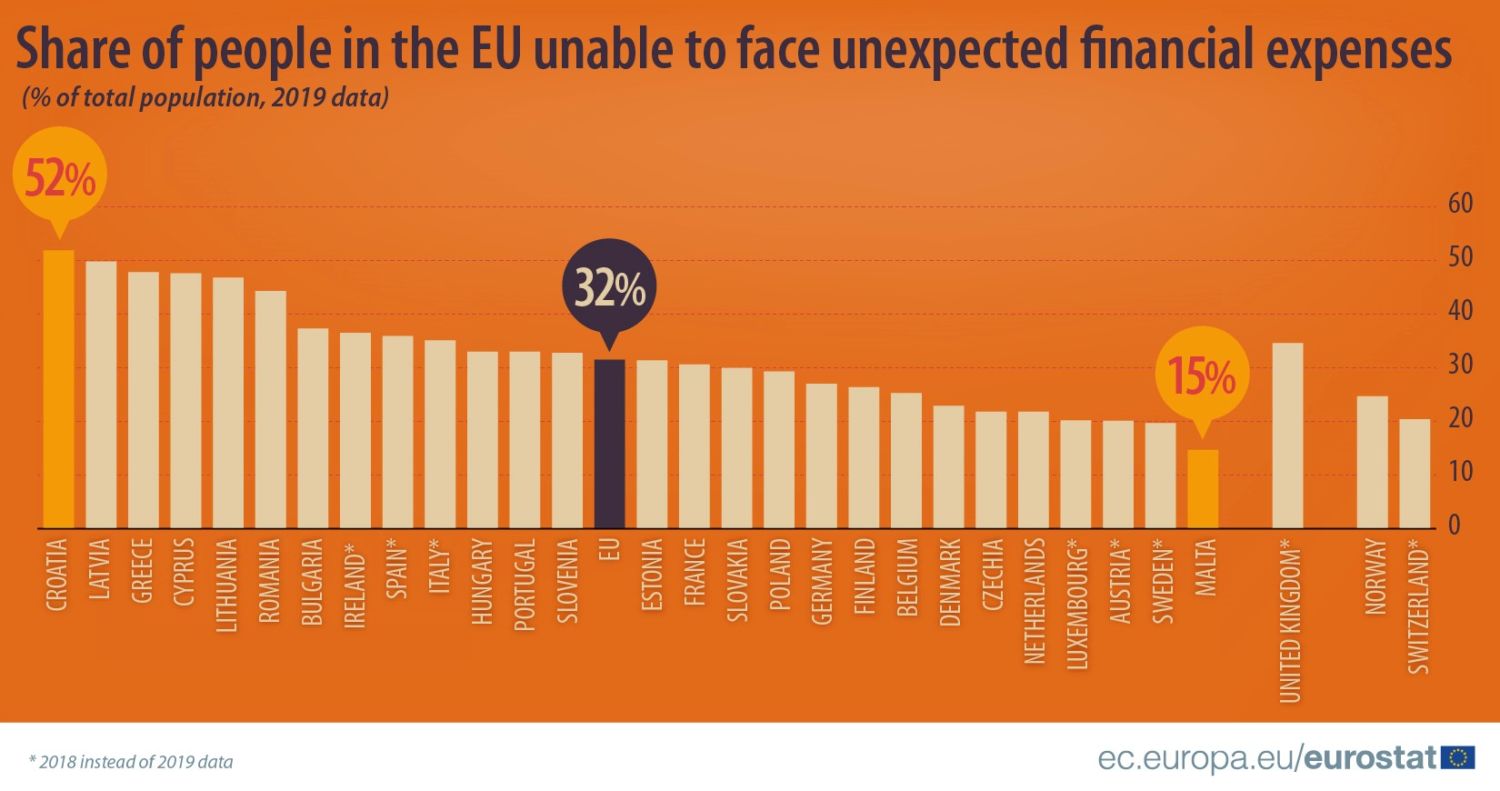

Nearly one in two people in Cyprus were unable to face unexpected financial expenses in 2019 – the third highest in the EU and well above the EU average of 32%.

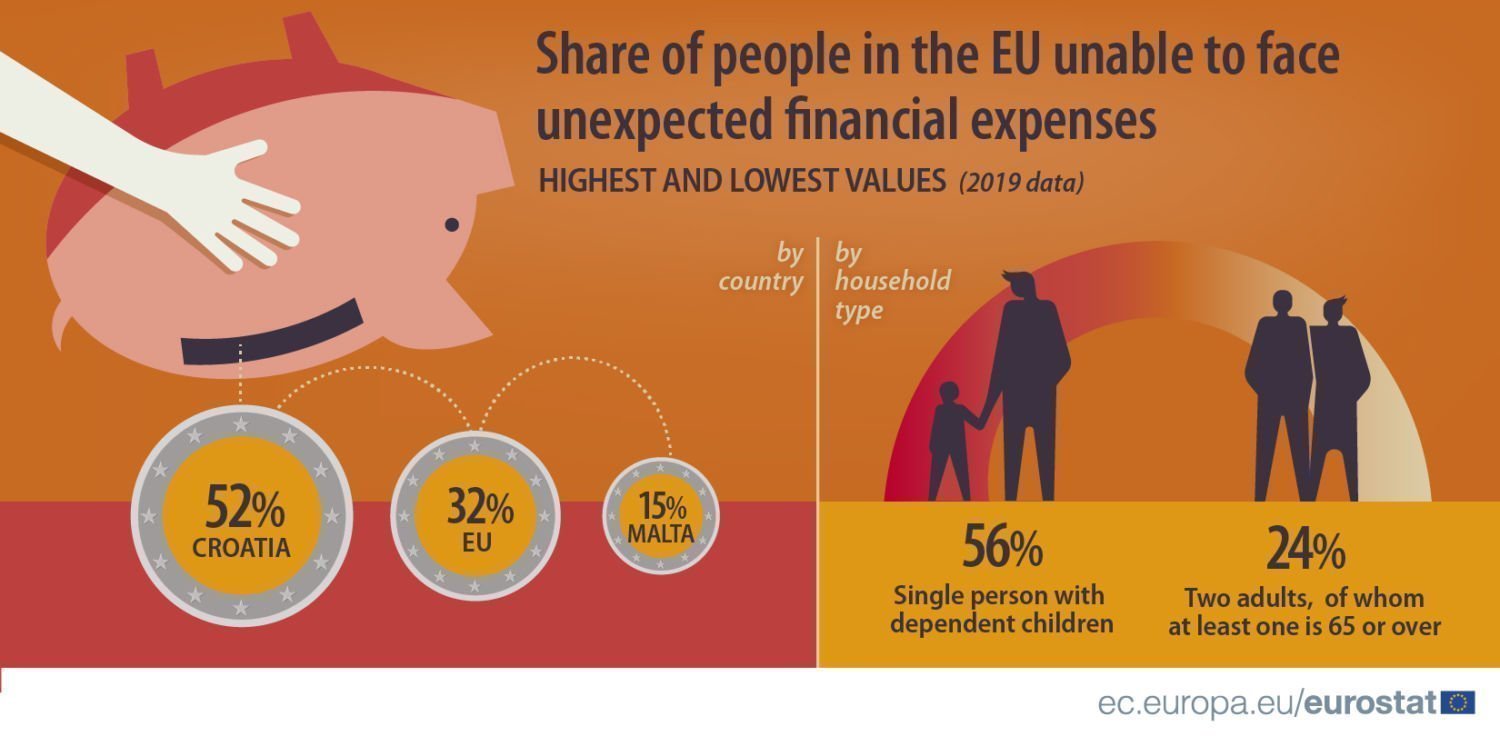

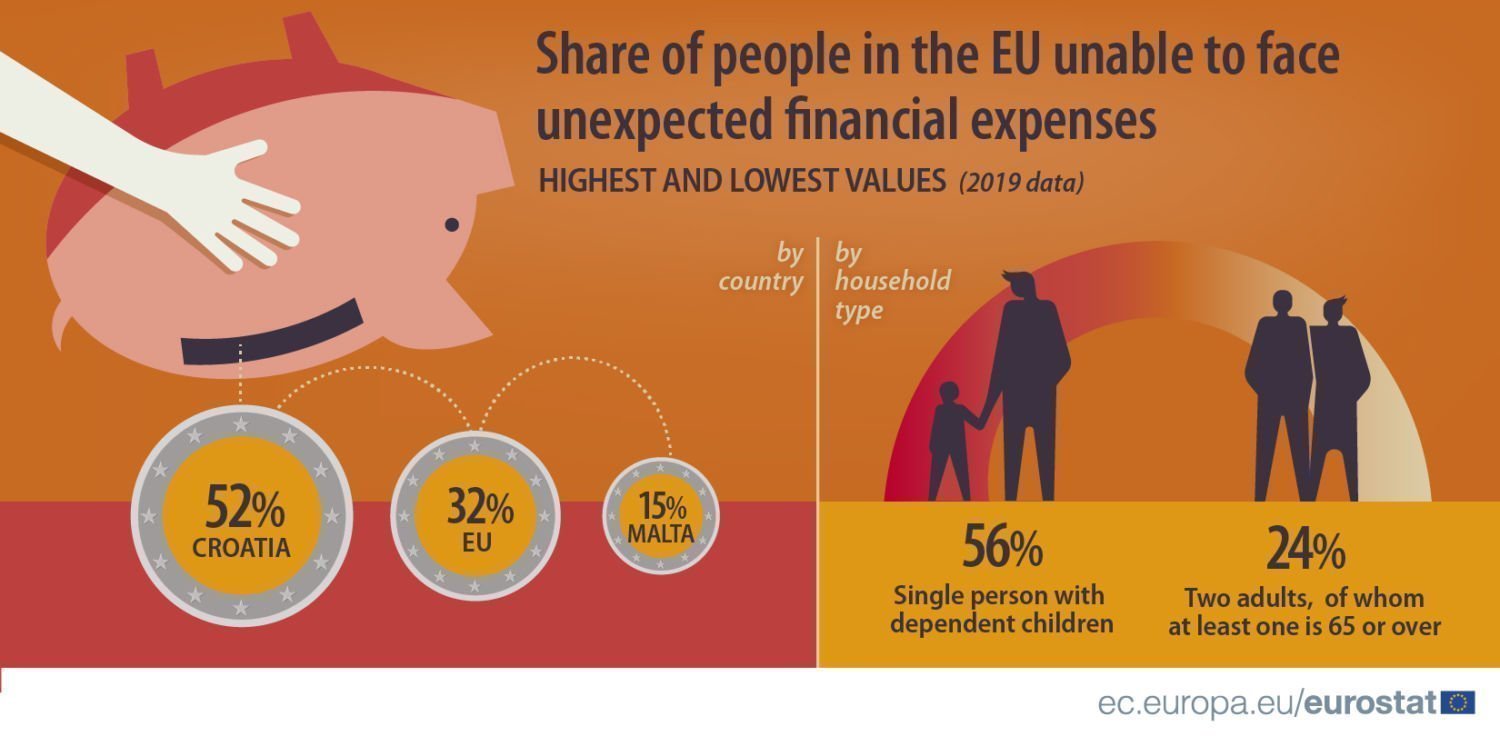

According to figures issued by Eurostat on Tuesday, overall in the EU, almost one in three people were unable to face unexpected financial expenses (32%) in 2019.

These people were not able to face unexpected financial expenses such as costs for surgery, a funeral, a replacement of washing machine or a car in 2019.

Since its peak in 2012 (40%), the ability to handle unexpected expenses has improved markedly. Due to lockdown implemented across the world in 2020 to slow down the rapid spread of the coronavirus, the ability to face unexpected financial expenses is crucial, especially in case of loss of income.

The highest shares of people unable to face unexpected financial expenses was reported among single person households: 40% of single persons were unable to face unexpected financial expenses, and in particular 56% of single persons with children. Higher shares were recorded for single females (43%) than for single males (36%).

In contrast, the lowest shares were recorded in households with two adults: 25% were unable to face unexpected financial expenses; 28% of two adult households with one dependent child and 26% of those with two dependent children.

Among all household types, the proportion of people unable to face unexpected financial expenses was lowest for two adults, of whom at least one is 65 or over (24%).

Inability to face unexpected financial expenses highest in Croatia, lowest in Malta

Among the EU Member States, the share of people unable to face unexpected financial expenses was highest in Croatia (52%), followed by Latvia (50%), Greece and Cyprus (both 48%), Lithuania (47%) and Romania (44%).

Fewer than one in four people were unable to face unexpected financial expenses in Denmark (23%), Czechia and the Netherlands (both 22%), Luxembourg, Austria and Sweden (all 20%, 2018 data) as well as Malta (15%).

Figures for Cyprus show the number dropping from 56.6% in 2016 to 50.1% in 2017, 49.5% in 2018 and 47.6% in 2019.

The problem here was most acute in a household with one adult and dependent children (73.9%) followed by a household with three or more adults with dependents and two adults with three or more dependent children (57.8%).

Source dataset: ilc_mdes04

Source dataset: ilc_mdes04